Blog

Blog

This blog is part of a series documenting our program’s journey to accelerate the development of inclusive payments systems for universal access to financial services in Africa. #IAmAfricaNenda

Urgent Need to Harmonize Payment Service Regulations and Achieve Instant Cross-border Payments in Africa

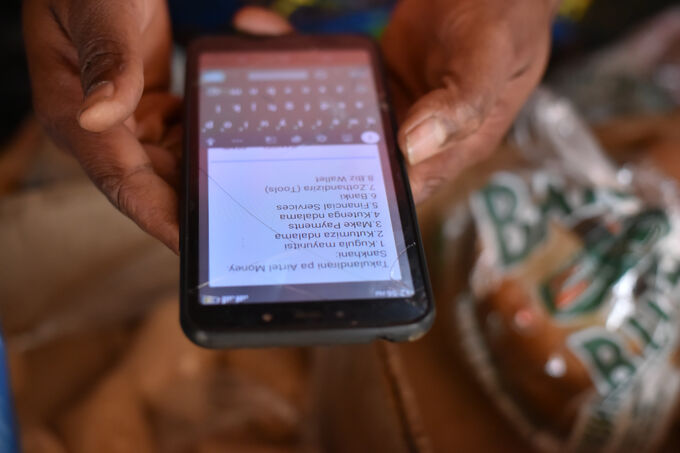

Africa stands at a decisive moment in its digital finance evolution. Innovation is accelerating, mobile money is ubiquitous, and instant payment systems are fast growing across the continent. Yet one force continues to constrain seamless cross-border payments in Africa: regulatory fragmentation.

Read moreMore information about this topicLatest blogs

Blogs

Lack of transparent data is hampering Africa's capacity to leapfrog inclusive instant payment systems!

While on a speaking tour in 2022 to disseminate findings from a report I co-authored, a central bank official from West Africa shared a key observation. Our report aimed to document the relationship between financial inclusion and the infrastructure provided by inclusive, instant payment systems and was based on publicly available data. But as the central bank official shared, the research was incomplete, because the publicly available data their country provided was outdated. Within a month, the central bank had updated its website and issued a press release with official statistics.

Blogs