News

The Global Findex 2025: Could Instant Payments be Driving Financial Inclusion in Africa?

by Sabine F. Mensah, deputy CEO at AfricaNenda - 15 August 2025

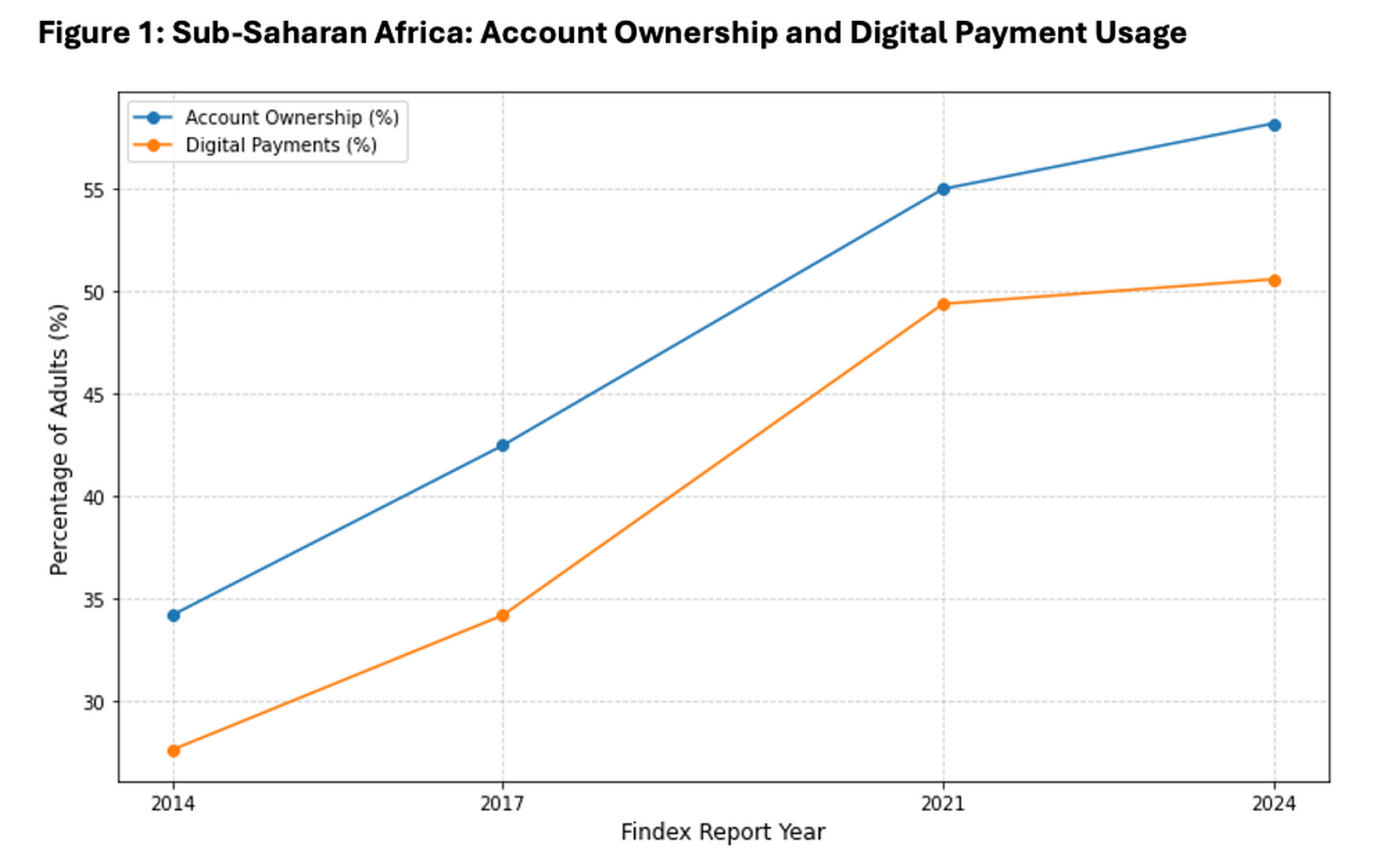

Financial inclusion advocates across Africa had reason to celebrate with the launch of the Global Findex 2025. According to new data (see Figure 1), the share of adults in Sub-Saharan Africa with either a bank or mobile money account grew from 34% to 58% between 2014 and 2024. Almost 6 in 10 adults now have an account.

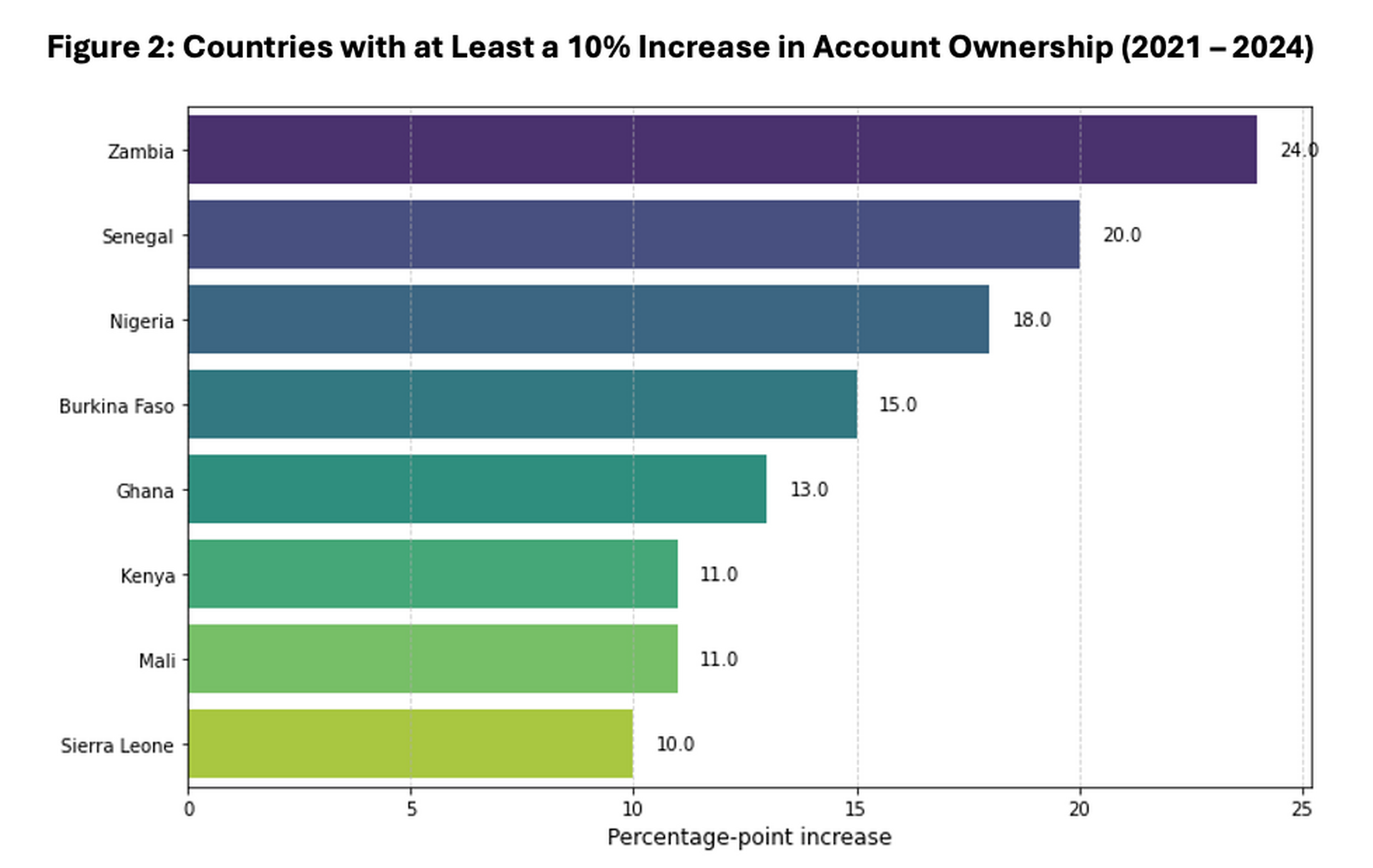

In the past three years alone, 8 economies grew their account ownership rates by 10 percentage points or more, including three (Nigeria, Senegal, Zambia) that saw a 20-percentage-point or higher increase (see Figure 2).[1]

The share of adults using digital payments has also nearly doubled since 2014, such that by 2024, 51% of all African adults—88% of African account owners—had made or received a digital payment. These results are encouraging. Yet they also hide a great deal of variability across the continent, which includes countries that saw no, or in some cases negative, financial inclusion growth since 2021. What accounts for these differences?

Considering markets are complex systems involving diverse factors that stimulate or suppress financial inclusion, Africa is noteworthy for the fact that many nations within the continent are building or modernizing their national payment systems to serve as digital public infrastructure. Referred to as instant payment systems (IPS) or sometimes fast payment systems (FSP), the increasing popularity of these systems begs the question: How have IPS contributed to Africa’s financial inclusion?

To answer it, we leveraged the Global Findex 2025 data to compare financial inclusion growth rates in African countries that have, since 2014, launched government-supported IPS with those that have not, using IPS data from the State of Inclusive Instant Payment Systems in Africa 2024 report.

Our findings show a strong correlation between having a domestic, interoperable IPS and achieving above-average increases in financial account ownership and digital payment usage. First, let’s clarify what we mean by an IPS, then we can take a closer look at the examples we used.

Analyzing the Impact of Inclusive IPS

IPS are national or regional-scale payment systems that enable low-value, low-cost transactions between licensed payment providers. When designed to be inclusive of all payment providers in a market and all potential end users, these systems provide the payments layer for a national digital public infrastructure. They complement private payment systems to ensure that every adult can make affordable, convenient, and safe digital payments.

IPS in Africa come in different forms: bank IPS that only include bank payment service providers (PSPs) as participants, mobile money IPS that include only mobile money providers, and cross-domain IPS that include bank and non-bank PSPs. For the purposes of this analysis, we include only cross-domain IPS.

Using the landscape data from the State of Inclusive Instant Payments in Africa 2024 report, we identified seven countries in Africa that launched a cross-domain IPS at some point between January 2013 and March 2023. These dates were chosen based on the availability of Global Findex data to allow for a before-and-after IPS launch comparison. The sample countries are Egypt, Ethiopia, Ghana, Malawi, Mozambique, Tanzania, and Zambia.[2]

For comparison purposes, we selected a group of “control” countries that do not have cross-domain IPS yet and are similar to the sample countries in size and regional distribution. Here’s what we found.

IPS Countries See Faster Growth in Both Financial Account Ownership and Payment Usage

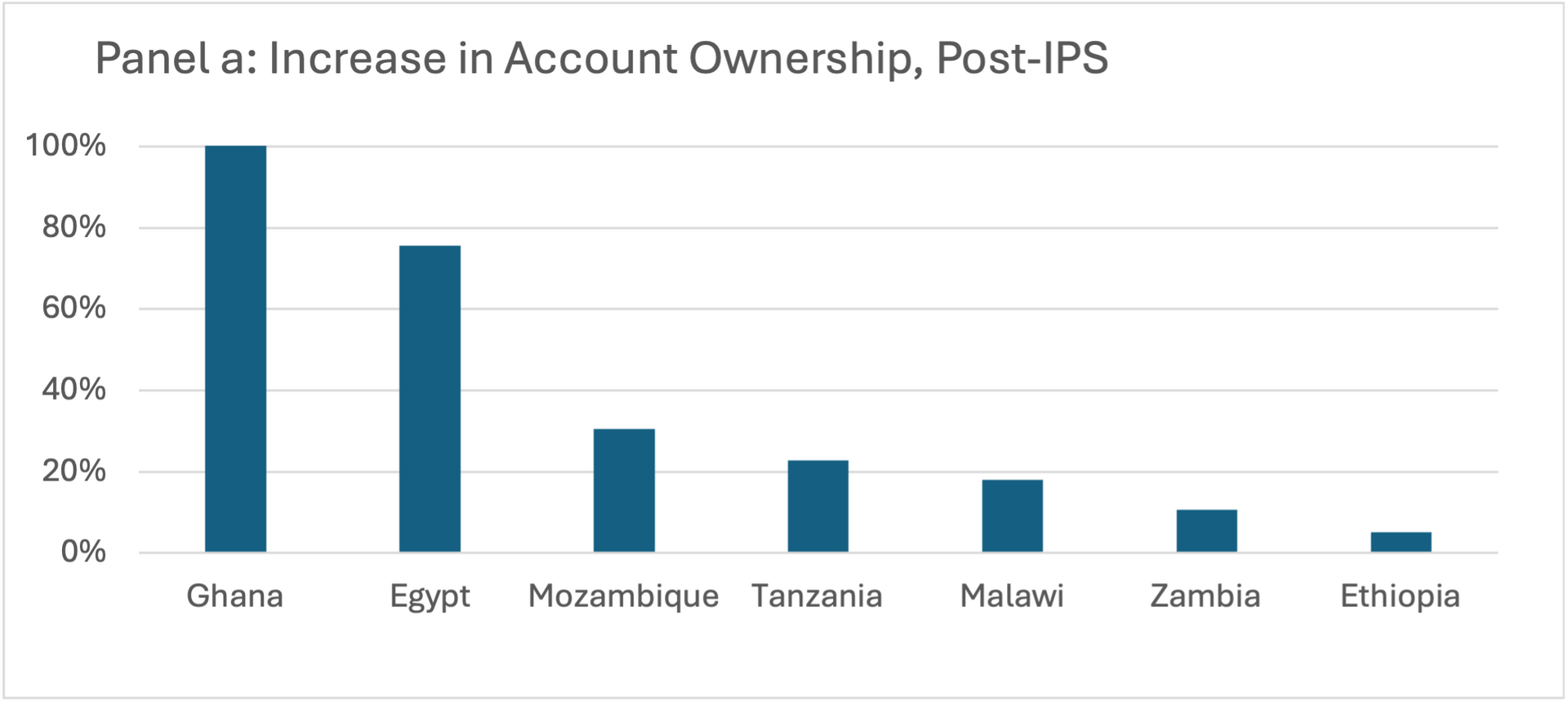

In the sample economies with a cross-domain IPS, account access grew by an average rate of 37% in the two years after launch. The control economies without a cross-domain IPS saw only 14% account ownership growth.

Figure 3: Countries with a Cross-domain IPS see Faster Account Ownership Growth in the Years after IPS Launch than non-IPS Countries Do.

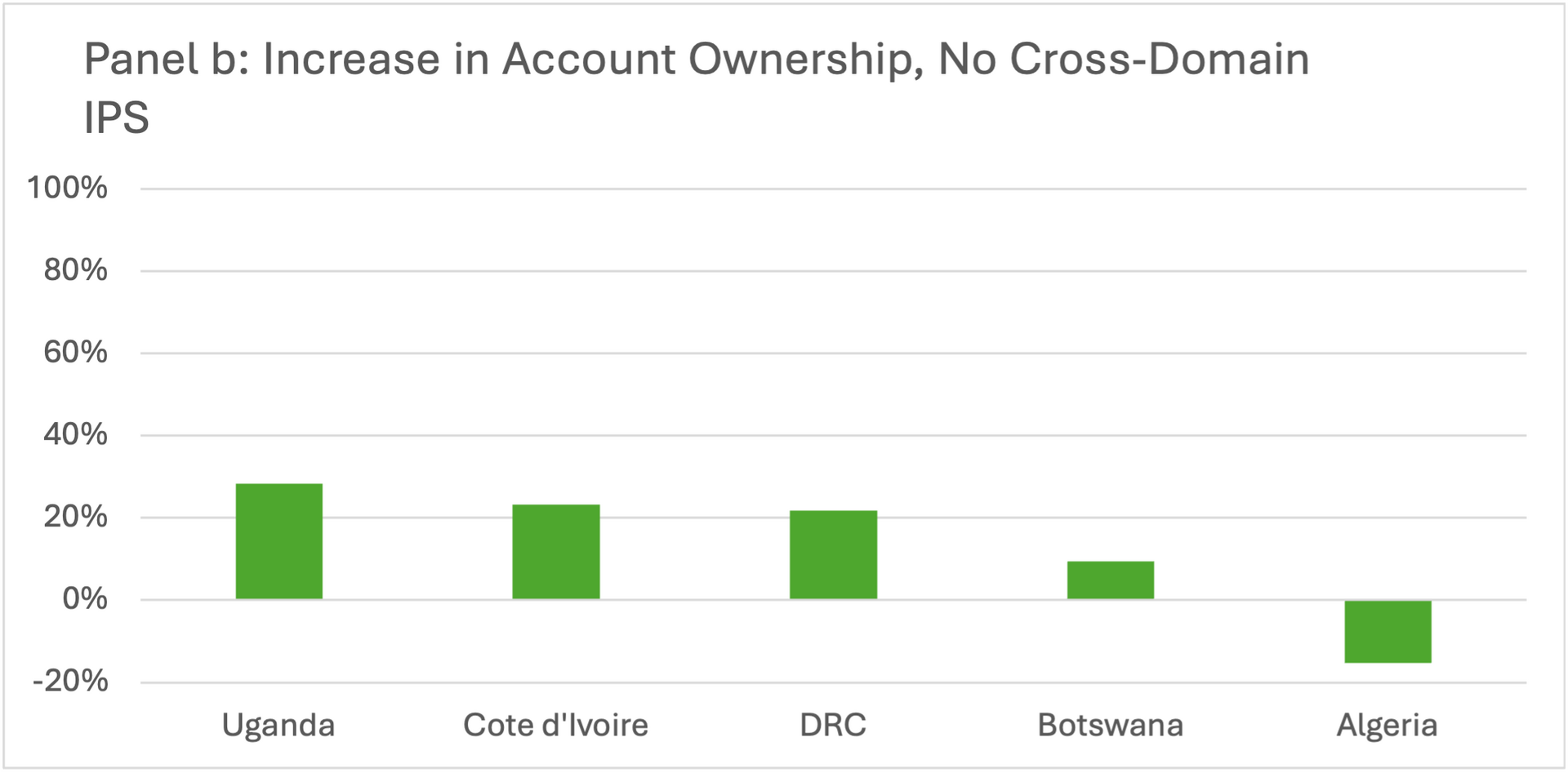

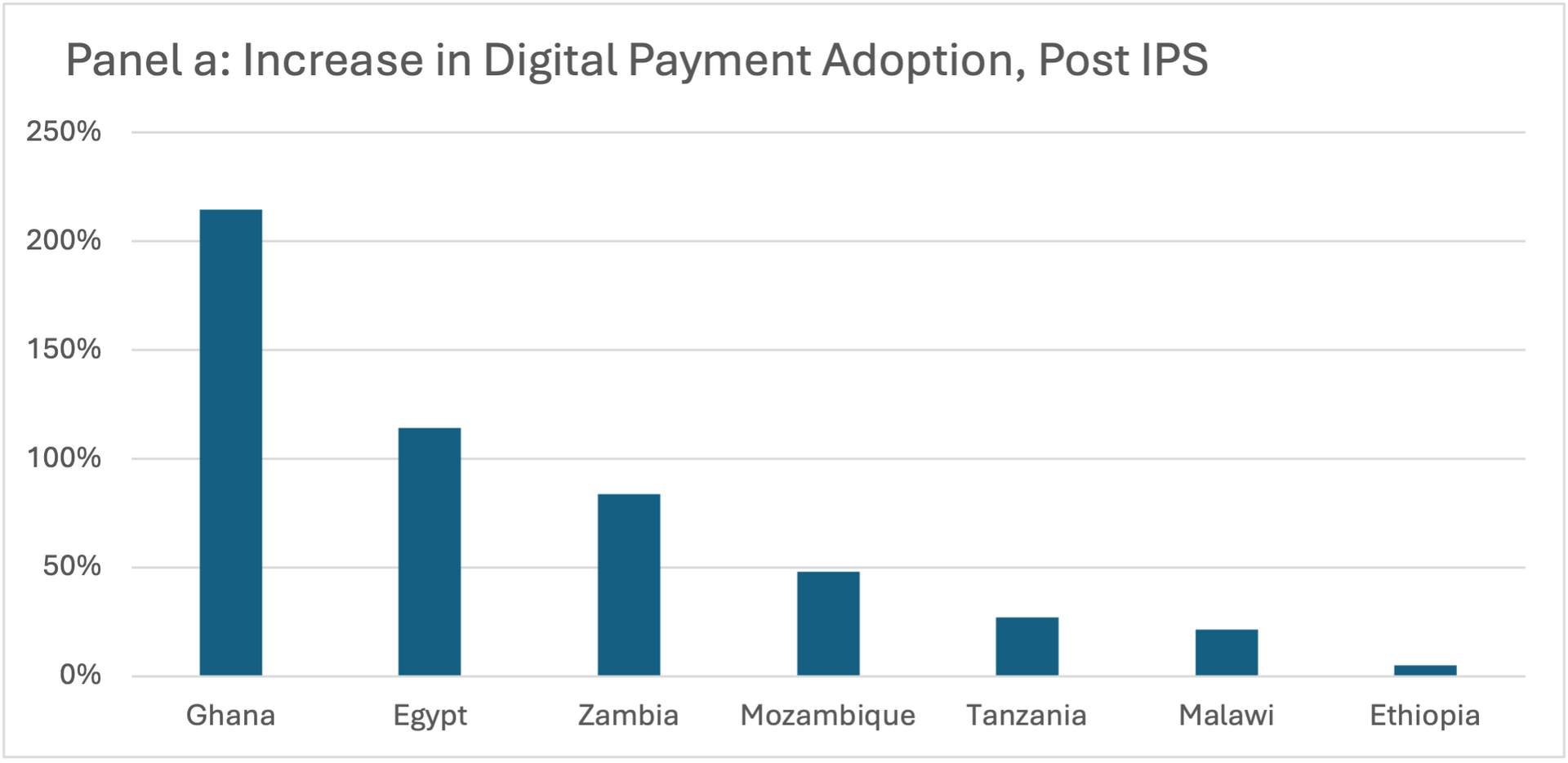

Digital payment adoption saw a similar average pattern between IPS countries and non-IPS countries. In the sample economies, payment use grew 73% on average in the years after the launch of an IPS, compared to 15% growth in the control economies.

Figure 4: Countries with a Cross-Domain IPS See Faster Growth in Payment Use in the Years after IPS Launch than Non-IPS Countries Do

IPS contribute powerfully to the financial ecosystem, but they are not the only driver

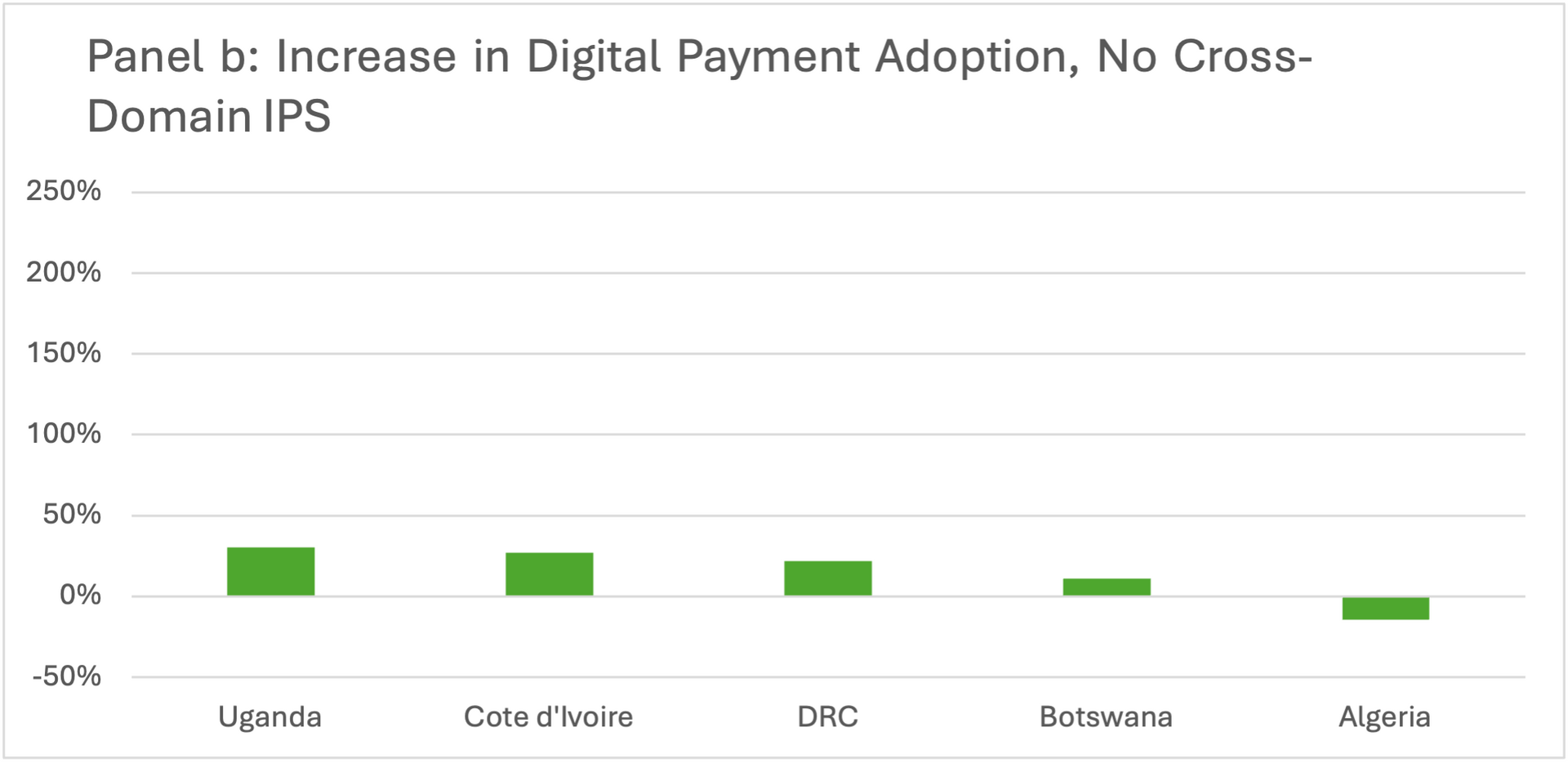

Averages do not tell the full story of financial inclusion in countries with and without IPS. In both the sample and control countries, there is significant variation.

Ghana, for example, saw its account ownership rate increase by 100% in the years after launching its cross-domain system. Digital payment adoption also increased well above the average, in this case by 215%. Egypt likewise saw significantly above-average account ownership growth of 76% since 2022, when it launched its Instant Payment Network (IPN) IPS; its rate of digital payment adoption grew by over 100%. Ethiopia, in contrast, saw more modest growth of 5% in account ownership and 5% in digital payment adoption in the years after the launch of its IPS, EthSwitch. This is slower than almost all the control economies (and below the Global Findex threshold for statistical significance, given that the change appeared as a difference of just 1 percentage point between 2021 and 2024).

Meanwhile, some of the countries without cross-domain IPS saw account ownership growth on par with one or more IPS countries, including the Democratic Republic of Congo and Uganda. Both have growing mobile money markets, which may account for their account ownership and payment increases even in the absence of a cross-domain IPS.

This points to the reality that IPS do not operate in a vacuum. The location in which a country starts its IPS journey affects how much of a boost the IPS infrastructure provides. Enabling foundations like widespread mobile phone ownership and competitive financial markets can help accelerate IPS impact at launch. These factors may also allow a country to make progress without a cross-domain IPS, as seen in Kenya and South Africa.

These caveats notwithstanding, the available evidence points to IPS as a strong enabler of financial inclusion in the form of increased account ownership and digital payment usage. As such, the role of regulators is critical in leading the development of inclusive IPS, ensuring that inclusivity and client centricity are driving the value proposition of the IPS from design to implementation to enable strong network effects for more adoption and usage.

[1]Source:The Global Findex 2025

[2] Angola, Nigeria, and Rwanda also have cross-domain IPS, but were left out of this analysis. In the cases of Angola and Rwanda, neither country has been included in the Global Findex database for multiple rounds. In the case of Nigeria, its IPS launched in 2011, before the first round of Global Findex data was collected, making a prior benchmark unavailable.