News

AfricaNenda & GIMAC: Building an inclusive payment ecosystem in Central Africa

by Jamelino Akogbeto, Regional Director for West and Central Africa at AfricaNenda Foundation - 25 August 2025

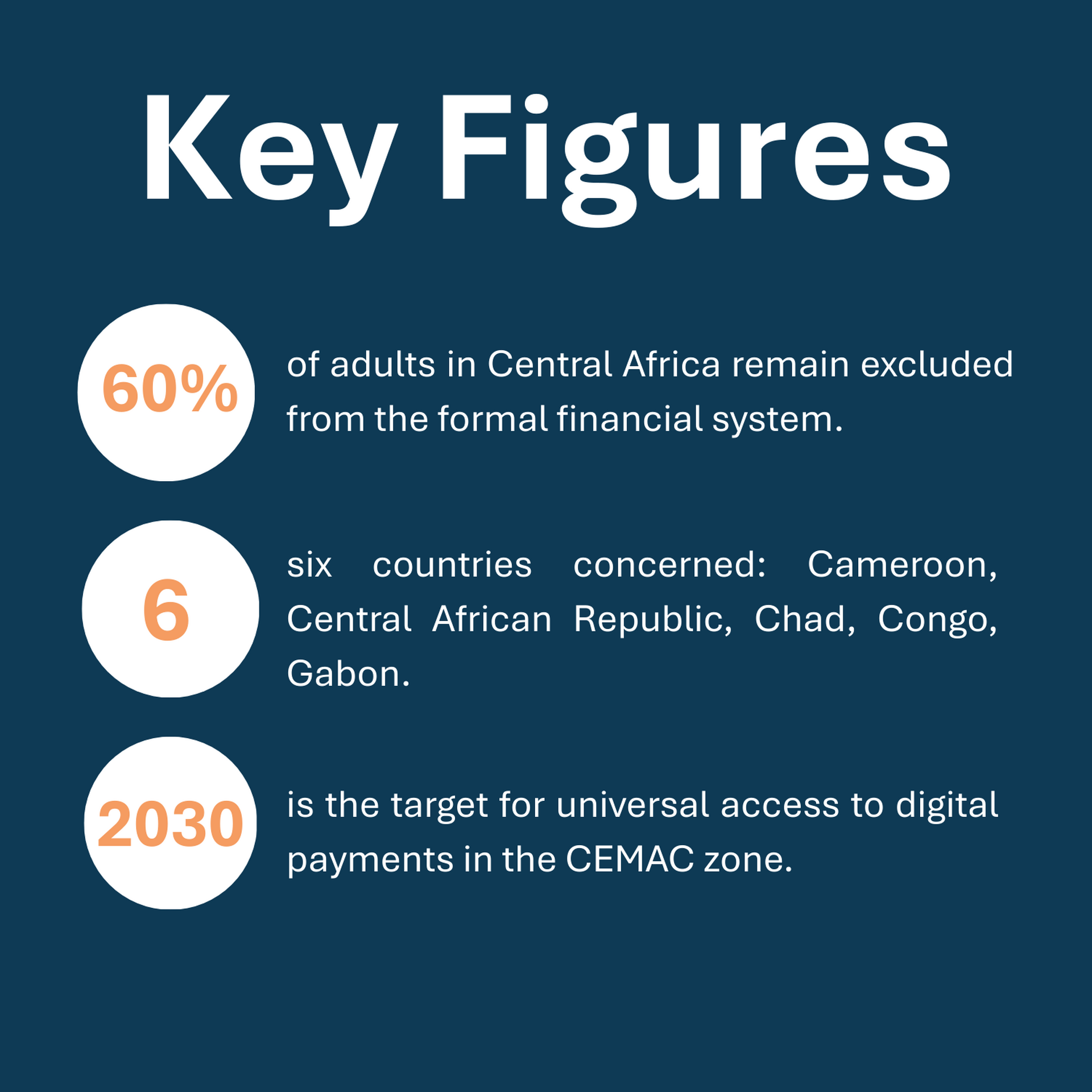

In Central Africa, nearly 60% of adults remain excluded from formal financial systems. However, mobile phones have initiated a silent revolution in financial access. The challenge is that digital payments still operate in silos, which limits their full potential. AfricaNenda Foundation, a non-profit organization dedicated to promoting financial inclusion, and the Interbank Electronic Banking Group of Central Africa (GIMAC), a regional financial institution, aim to change this situation through a strategic partnership launched in September 2023.

Their goal is to create a secure, interoperable ecosystem accessible to everyone in the six countries of the Central African Economic and Monetary Community (CEMAC). Essentially, they want to allow a merchant in Cameroon to accept payments from a Congolese customer's mobile account easily. "We want payments to be as simple and universal as a text message," explains Jamelino Akogbeto, Regional Director for West and Central Africa at AfricaNenda Foundation.

From vision to action

From March 12 to 14, 2024, Douala hosted the first regional workshop to establish the foundations for this technical and strategic partnership. Over the course of these three days, representatives from the six CEMAC member countries, along with participants from banking institutions, microfinance entities, mobile money operators, and fintech companies, discussed issues related to the inclusivity of payment systems and shared international best practices.

"The challenge goes beyond technology. It is not enough to connect platforms; we need to create a harmonized framework that benefits both merchants and consumers," noted Valentin Mbozo'o, Director General of GIMAC. "At the same time, we must build trust, simplify usage, and ensure that the most vulnerable populations are included."

The discussions not only focused on the architecture of the payment systems but also considered regulatory challenges, consumer protection, and user experience. Experts shared lessons learned from successful instant payment systems in other countries, particularly Brazil's Pix and India's Unified Payments Interface (UPI), which are often cited as models for success.

According to Jamelino Akogbeto, "The Douala workshop facilitated the sharing of international standards, the identification of regulatory and commercial challenges, and the exploration of avenues for wider adoption of the GIMACPAY system."

An Ambitious Project

The implementation phase of the project commenced in July 2025, focusing on testing a merchant payment system utilizing QR codes and reviewing the economic model, operational rules, and, in particular, the management of complaints. Recommendations will be discussed with system participants and then adopted by GIMAC.

At the heart of this initiative is GIMACPAY, the regional infrastructure that already connects banks, microfinance institutions, mobile operators, and fintechs. While a network exists, its potential remains underutilized, especially for merchant payments and cross-border transactions.

Despite the enthusiasm surrounding this project, significant obstacles remain, and the endeavor is considerable. For AfricaNenda Foundation, success will depend on close support, including:

- Improving coordination among stakeholders

- Optimizing the user experience to make it more intuitive

- Adapting solutions to meet the needs of unbanked populations, often located far from major urban centers

"Financial inclusion cannot be decreed. It must be built step by step by listening to users and adapting solutions to their realities," emphasizes Mr. Mbozo'o.

Towards More Inclusive Finance

By 2030, AfricaNenda and GIMAC hope to enable every resident in CEMAC—from the fishmonger in Douala to the cocoa farmer in Obala—to send and receive instant payments, regardless of their bank or service provider.

This project, which combines technical expertise, institutional support, and an inclusive vision, could represent a significant turning point for financial integration in the region. "The future of payments in Central Africa will not be determined solely by servers and standards, but by our ability to engage the entire population in this digital transition," concludes Jamelino Akogbeto.