News

The role of inclusive payment systems in Africa's financial inclusion

by Djeinaba Kane, Advocacy and Partnerships Lead - 30 May 2023

The COVID-19 pandemic showed the critical importance of digitization when travel and physical interactions were severely restricted. As digital platforms such as Zoom and Microsoft Teams became the new normal for work interactions, the increase in usage of e-commerce platforms enabled commercial activities to continue. Consumers needed to rely on digital services to purchase goods and services and to receive government-to-person (G2P) payments. In line with the Digital Financial Services Policy 2020 in Africa, Togo, for example, designed and launched an all-digital G2P payment program called Novissi, to relieve the financial disruptions its population was experiencing because of the pandemic. The program processed government payments to hundreds of thousands of Togolese. The G2P social cash transfer payments reached the poorest and most vulnerable sections of the population, including rural populations, contributing to greater financial inclusion in the country.

The COVID-19 pandemic also spurred financial inclusion by driving broad adoption of digital payment services such as instant and inclusive payment systems The Bank of Ghana, for instance, published measures aimed at promoting digital forms of payment that were retained for the duration of 2020. These included simpler, minimum Know Your Customer (KYC) requirements for mobile money accounts and higher transaction limits. Ghana is one of the five countries in Africa to be at the “Progressed” level of inclusivity through its combination of three national systems (the inclusion triangle) and an inclusive functionality, supporting the most-used channels and essential use-cases ( person to person (P2P) and person to business (P2B)).[1] Approximately 41 percent of adults in Africa with transaction accounts made a digital payment in 2021, compared to 27 percent in 2017 (World Bank Findex, 2022). The experience in these two examples shows Inclusivity in payment systems is a critical step in the journey to greater financial inclusion in Africa.

Inclusivity in payment systems entails providing access to financial services to all people regardless of location, socioeconomic status, or whether they have a bank account.

According to the 2022 State of Instant and Inclusive Payment Systems, “Instant and inclusive payment systems (IIPS) process retail transactions digitally in near real-time and are available for use 24 hours a day, 365 days a year, or as close to that as possible. They enable low-value, low-cost push transactions that are irrevocable and based on open-loop and multilateral interoperability arrangements. Licensed payment providers have fair access to the scheme, and participants have equal input opportunities into the scheme. The central bank has a role in scheme governance. End-users have access to a full range of use cases and channels, as well as transparent and fit-for-purpose recourse mechanisms.”

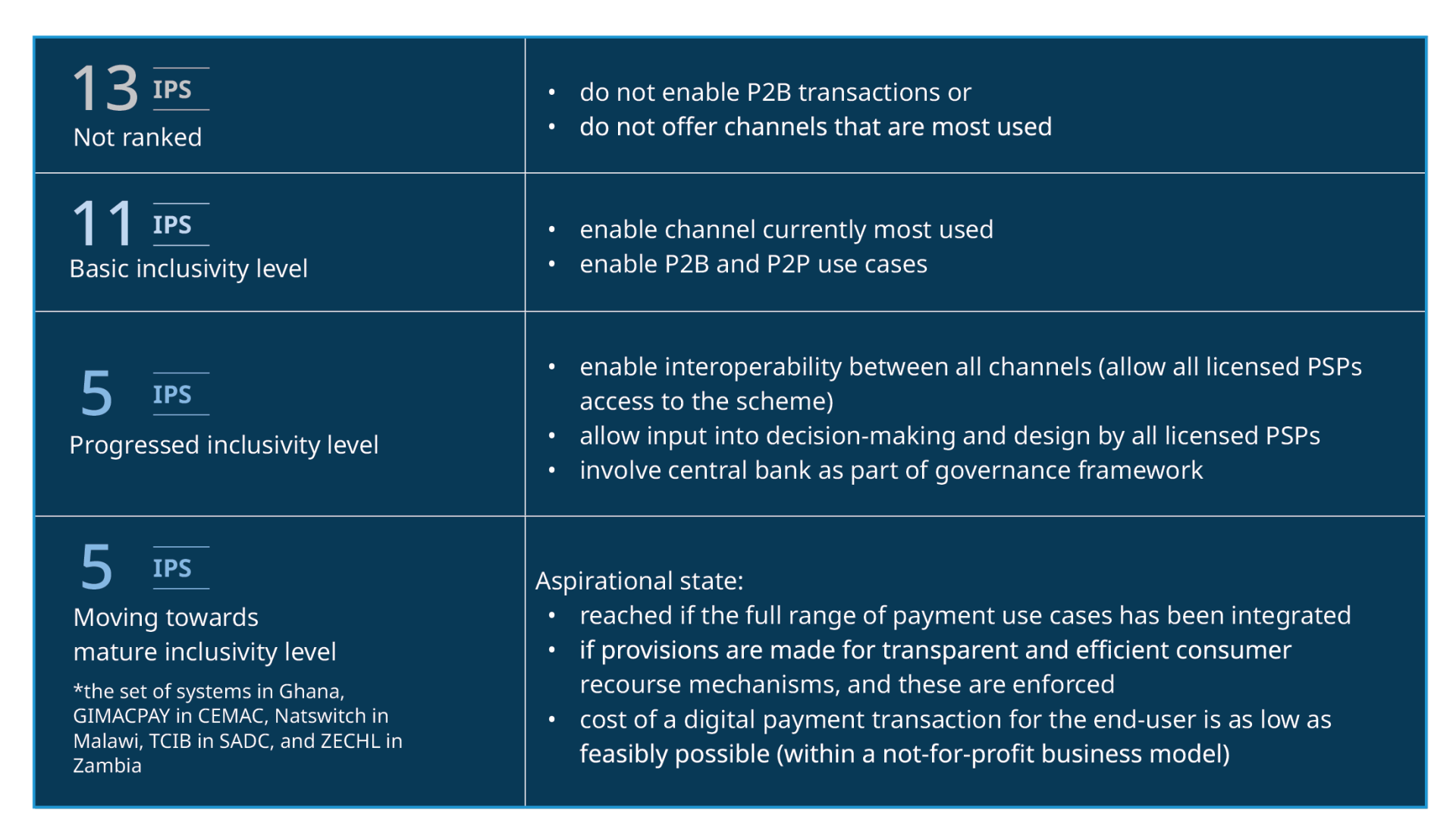

The inclusivity level of Instant payment systems in Africa were classified between Basic, Progressed and Matured level. The SIIPS report states that 11 instant payment systems in Africa can be considered to meet basic levels of inclusivity, and 5 are moving toward mature status.

The Inclusivity aspiration is to have all IPS at a mature level and all use cases fully integrated at a low cost for consumers; however, financial services providers (FSPs) will first need to address some barriers before they can make their payment systems more Inclusive. FSPs, including mobile network operators (MNOs), banks, and fintechs should be fully integrated, whether transaction volumes are small or large, which would give more digital payment use case options to end-users (G2P, P2P, P2B).

The reality on the ground is that most large banks and financial institutions are not motivated to integrate with smaller providers because of the limited value proposition and high cost. In addition, infrastructure and digital constraints in most African countries combined with limited consumer literacy create a high-cost base that limits access and drives the cost of delivery to providers. These cost drivers result in high transaction fees for end-users, which affect the level of end-user engagement. Complex regulatory frameworks also delay competition and innovations in payment systems so that fewer use cases are available to consumers.

As governance structures and payment schemes cater more to large players in the financial services ecosystems and most of them do not allow non-banks to participate in decisions, fintech, and micro-savings and loan institutions have less access to push their services, given the regulatory restrictions.

African countries need to acknowledge the contributions of non-banks in the overall digitalization journey. In Kenya, for instance, financial inclusion nearly quadrupled, from around 25 percent in 2006 to nearly 85 percent in 2021, through the increasing adoption of Kenya’s M-Pesa and other payment solutions. Also, in October 2021, Standard Bank, Africa’s largest bank by assets, partnered with African unicorn Flutterwave to enhance the digital payments experience for its customers in eight African countries.[2] Collaboration between large financial institutions and fintech have proven to benefit end-users by offering them more payment solutions and wider reach that were previously unavailable.

For payment systems providers, collaboration will be the best way to address the inclusivity gap in instant payment systems in Africa. Start-ups and incumbents should further collaborate to enable more use cases and functionalities and to contribute to the development of governance structures of payment schemes with regulators that cover and protect different types of FSPs, no matter their size and revenue. This will allow end-users to have different payment options based on their needs and will eventually be a replacement for cash transactions across the continent. Digitizing payments not only boosts transaction efficiency, it also reduces costs and drives financial inclusion. A McKinsey analysis reveals that new technology-based solutions for everyday requirements such as buying airtime, transferring funds, and paying bills are available to lower-income households for up to 80 percent less than these services would cost with traditional banking players.[3] Through the adoption and acceptance of Innovative solutions offered by non-banks such as fintech, Africa has the potential for greater adoption of digital payments, which in turn will help to close the financial inclusion gap on the continent.

[1]The State of Instant and Inclusive Payment Systems in Africa (2022) pp. 113-114

[2]https://www.standardbank.com/nigeriabank/personal/news/Standard-Bank-Selects-Flutterwave

[3]https://www.thebanker.com/Transactions-Technology/Payments-innovation-the-key-to-financial-inclusion-in-Africa