News

The Role of CBDC in Financial Inclusion - Part I

by Felista Amagarat, Senior Research Analyst - 17 October 2023

In the quest to close the financial inclusion gap in Africa, Central Bank Digital Currencies (CBDCs) have emerged as a potential game-changer. Their effectiveness in promoting financial inclusion remains uncertain. CBDCs vary in features and functions across nations, depending on policy choices and market environments. Potential benefits exist, especially in retail CBDCs, but realization depends on inclusive design. This two-part blog series explores the connection between CBDCs and financial inclusion in Africa, with a focus on the challenges faced by users of instant payment systems in the current financial landscape and how CBDCs might offer solutions. Part I explains what CBDCs are and how they can help advance financial inclusion in Africa; Part II discusses what’s needed to design and implement them.

Current State of Financial Inclusion

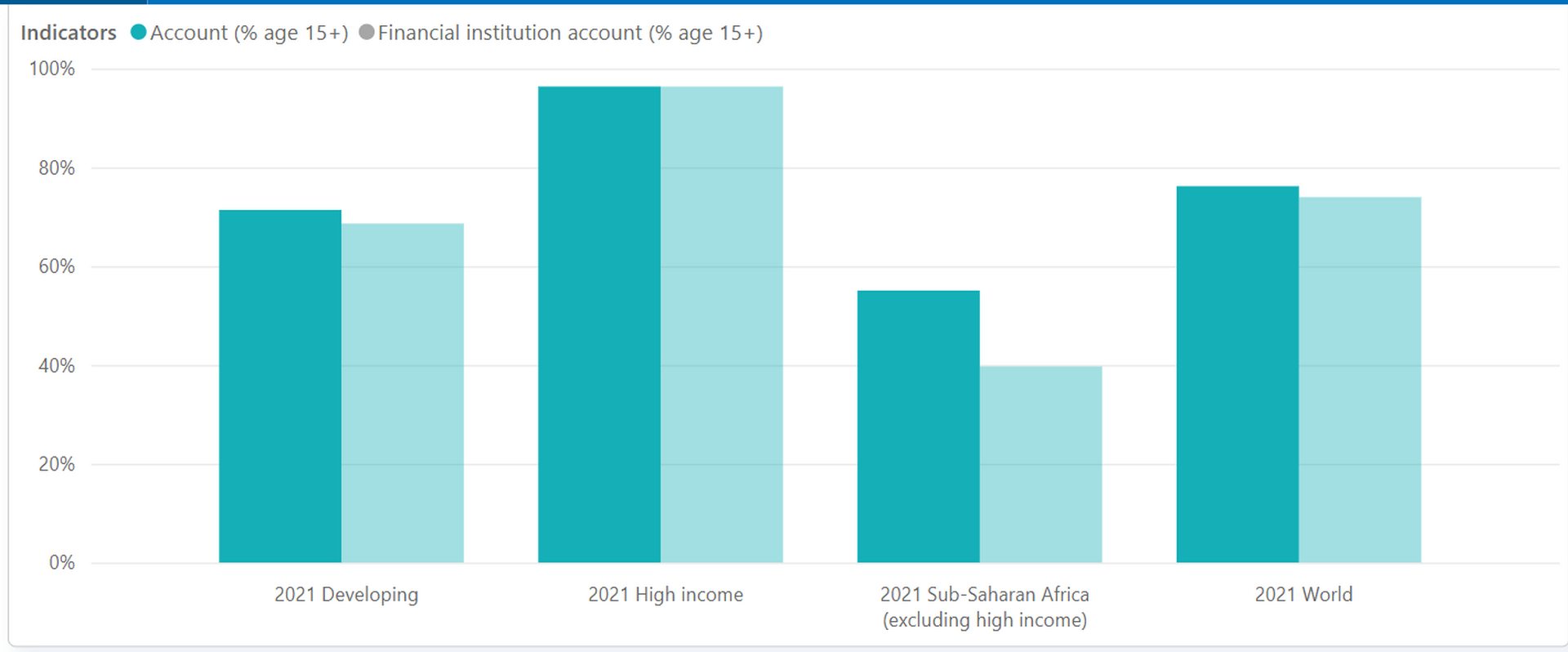

In Africa, both financial inclusion and formal financial inclusion lag behind other regions. At its core, financial inclusion is the pursuit of making sure that everyone, no matter where they live or how much they earn, can access and benefit from a diverse array of affordable financial services. Formal financial inclusion focuses on integrating individuals and businesses into the formal or regulated financial sector. It entails ensuring that people have access to financial services provided by licensed financial institutions, such as banks, credit unions, insurance companies, mobile money and microfinance institutions. Sub-Saharan Africa faces a staggering 15 percent gap between financial inclusion and formal financial inclusion, a much higher figure than the 2 percent or lower seen in other regions. This stark divide represents millions of people who do not have access to formal financial services—such as banks, credit unions, microfinance, or post offices, that fall under government prudential regulations—underscores the pressing need to address financial inclusion challenges on the continent.

Source: Global Findex 2021

Users of digital payments services in Africa encounter numerous hurdles when using digital payments services: the lack of transparency regarding fees and other terms of service, aggressive marketing, poor dispute resolution mechanisms, threats such as data or identity theft, mobile app fraud, and more (Global Findex Report 2021). The situation calls for innovative solutions that can empower individuals and businesses to access formal financial services seamlessly.

What Central Banks Can Do: Introduction to CBDCs

A 2022 survey conducted by Statista and the Official Monetary and Financial Institutions Forum found that improving financial inclusion was the second most significant motivator behind central banks’ decision to issue CBDCs, after the preservation of their role in monetary provision (28 percent vs 11 percent). Central banks can play a critical role in fostering more inclusive societies by enhancing the reach and value of formal financial products and services among the unbanked and underserved. They have the potential to not only create an enabling environment but also lead innovation. CBDCs are digital disruptions that can promote financial inclusion.

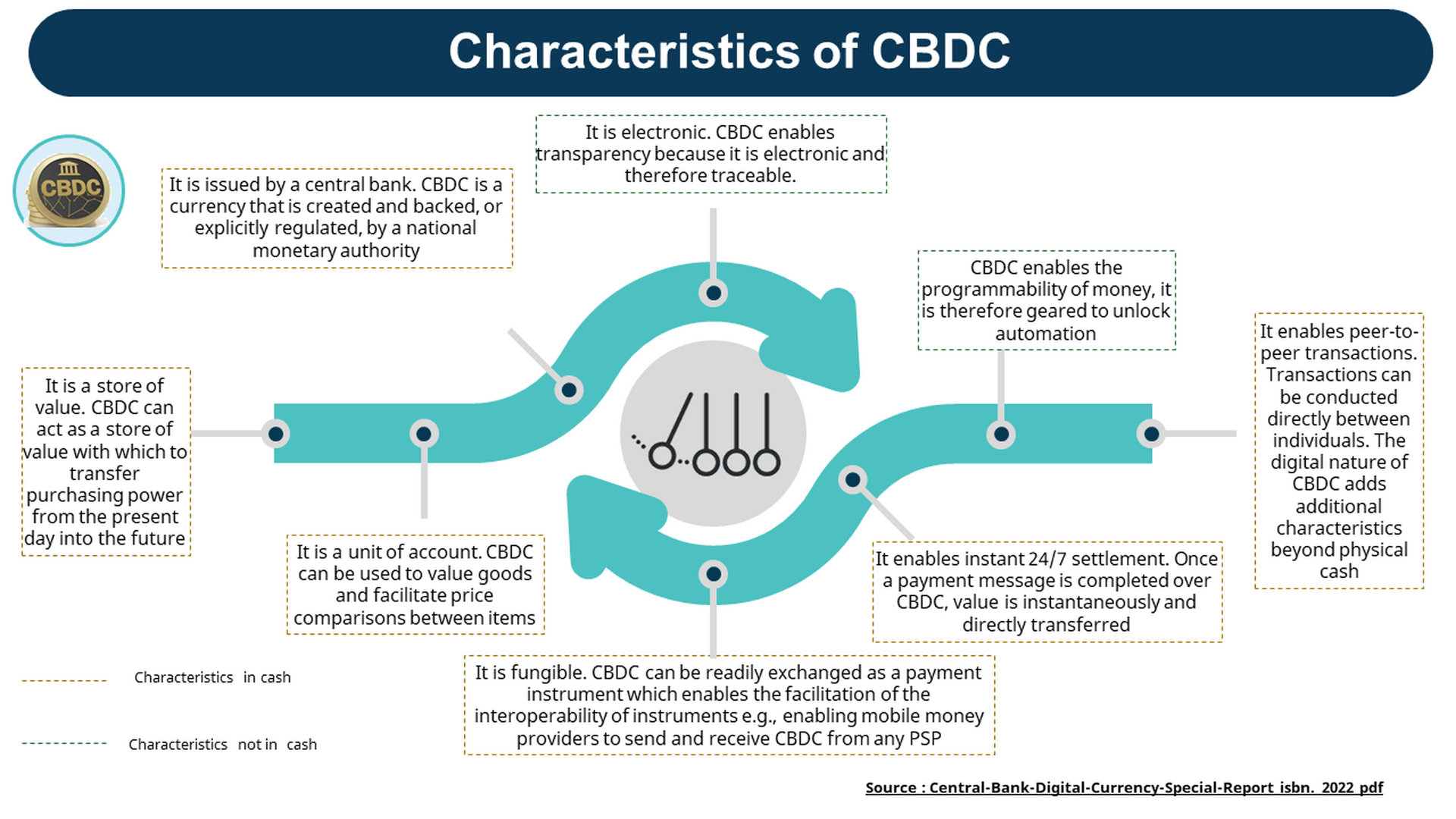

A CBDC is essentially publicly issued digital currency denominated in the national unit of account. It is issued and regulated by a country’s national authority or central bank. CBDCs offer the unique advantages of central bank money, including monetary stability, settlement finality, liquidity and integrity.

There are two primary types of CBDCs. Retail CBDCs are intended for the general public, including individuals and businesses. They mimic the characteristics of physical cash but exist in digital form. In contrast, wholesale CBDCs are primarily meant for interbank transactions and are accessible only to select financial institutions, akin to bank reserves. However, unlike bank reserves, wholesale CBDCs may be available to a wider range of counterparties and can interoperate with other payment systems, both domestic and foreign.

How Can CBDCs Promote Financial Inclusion?

Whether CBDCs can effectively promote financial inclusion is still a subject of ongoing debate. This is because a CBDC is not a one-size-fits-all solution; its features and functions can vary significantly depending on policy choices and market conditions in each country.

Nevertheless, there are potential benefits:

- Building trust: CBDCs can be a catalyst for building trust in digital payments. By facilitating faster and more accessible transactions, CBDCs can instill confidence in users, especially those who have been skeptical of digital financial services.

- Interoperability: One of the key advantages of CBDCs is their potential interoperability. This feature can unlock a wide range of convenient payment use cases, making it easier for individuals and businesses to transact seamlessly across different platforms and systems.

- Reducing costs: CBDCs have the power to reduce the costs associated with digital financial services. Lower transaction fees and overhead costs can translate into more affordable financial products, accessible to more people.

- Incentivizing digital adoption: CBDCs can create additional value for merchants by streamlining payment processes and reducing the reliance on cash. This, in turn, can incentivize digital adoption among businesses, encouraging them to embrace digital payment methods.

- Supporting digital literacy: To be truly inclusive, CBDCs can be designed with built-in features that cater to individuals with low digital literacy. User-friendly interfaces and educational initiatives can bridge the gap and ensure that CBDCs are accessible to everyone, regardless of their level of digital literacy.

- Supporting offline payments: Leveraging technologies such as offline wallets, tokenization, and smart cards, CBDCs can facilitate secure transactions even when an internet connection is unavailable. This feature can extend financial inclusion to remote or underserved regions where digital infrastructure is limited, fostering economic participation for more people.

These prospective impacts highlight the transformative potential of CBDCs in the context of financial inclusion. While the path forward may require careful planning and collaboration, the promise of a more inclusive financial landscape is within reach. In Part II we will explore the necessary steps to design CBDCs for financial inclusion.