News

Feeling the pulse: flagship report on Africa’s instant and inclusive payment systems expected soon.

by Sabine Mensah, Deputy CEO, AfricaNenda - 16 May 2022

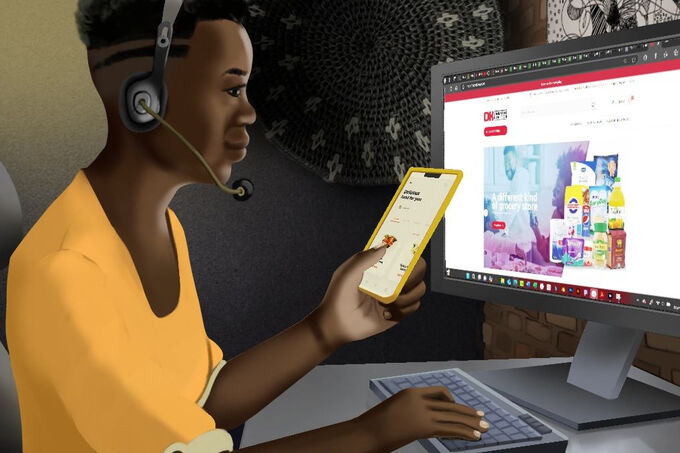

Fast, accessible, and more inclusive digital payments are booming across Africa. Efficient digital payments are more convenient for both the payer and the payee. They also have the potential to strengthen capital markets through a larger store of value in transaction accounts. Governments are increasingly focusing on supporting the roll-out of digital payments as a tool for financial inclusion. In Africa, digital payments are on a phenomenal growth path through the mobile phone. Mobile money has been instrumental in making payments more inclusive than traditional bank-account and card-based models. More than half of the mobile money services in the world are in Africa and merchant mobile money payments nearly doubled between 2020 and 2021. E-commerce is also on the rise, with a 24% increase by 2020, in line with investments in mobile infrastructure and burgeoning innovations in the financial services space.

If you own a phone, you are more likely than ever to be able to make a digital payment on the continent.

Instant payment systems allow consumers and merchants to transact faster. The speed of the payment, especially between different networks, is key to providing value - no consumer wants to wait in (physical or virtual) queues for their payment to go through. Instant payment systems (IPS) are increasingly transforming the payment landscape across the globe: 60 countries worldwide have an IPS, including at least nine countries in Africa. These systems make the funds available for the receiving end-user within minutes and are available 24 hours a day, seven days a week. Instant payments replicate the seamlessness of cash, as users can access their funds immediately instead of waiting days for a settlement. Also, like cash, these transactions can only be refunded, not reversed. The person initiating the payment has more control, which, combined with the speed allows them to manage their finances better. IPS can also enable governments to distribute social grants and subsidies more quicker.

IPS on the continent are growing. Several countries in Africa have already implemented national and regional IPS, as highlighted in AfricaNenda’s 2021 report, such as Nigeria’s NIBSS Instant Pay (NIP) and Ghana’s GhIPPS Instant Pay (GIP). NIP’s processed transactions increased by 43% between November 2020 and November 2021 (from 319 million to 224 million transactions). GIP’s performance was even more impressive, with a 272% transaction increase between the first quarters of 2020 and 2021 (from 6 million to 22 million transactions). There are also active projects to establish regional IPS, specifically to amplify the impact of the African Free Continental Trade Agreement.

Instant payments are a step in the right direction to going cashless, but alone they cannot drive inclusivity. Despite offering an alternative to cash, lower-income consumers still face a number of barriers, such as the high costs of using instant payments. Lower-income users who make small transactions using mobile money payments are often the ones to face higher fees. Inclusive instant payment systems (IIPS) are designed in a way that making and receiving payments is accessible to all through facilitating affordable low-value, high-volume digital transactions. The fact that they support remote payments means they can also be adopted for a wide range of use cases, from remittances to paying to businesses and government. They also allow people to send funds between different types of accounts and wallets, and across different networks. Adequate consumer protection and recourse assist in building trust for all users. Pro-poor governance of the payment system, including equal shareholding of its participants, a sustainable business model, and open access by the bank and non-bank providers within sound scheme rules, ensures responsible payment service provision.

Are the instant payment options offered by African nations accessible and affordable to all? Several countries, such as Ethiopia and Rwanda, have included aims to establish real-time and inclusive digital payment systems in their national payment strategies and visions. The DRC is also developing a national IPS. To make these payments accessible to all, a stock take of learnings on inclusiveness principles can assist in designing IPS. So far, there has been no public assessment of the level of inclusion of existing IPS on the continent. AfricaNenda, the World Bank, the United Nations Economic Commission of Africa and the African Union are partnering with Cenfri for this purpose - to embark on a new initiative to monitor and share the development of IIPS on the continent. The state of IIPS in Africa project will provide a basis of information to guide practitioners, governments, policymakers, and development partners in their design decisions on customer-centric, interoperable, and responsible instant payments infrastructure. An annual report will document IIPS in Africa, highlighting obstacles encountered in various contexts and identifying opportunities for progress. Each year will focus on a key topic, beginning this year with governance and stakeholder roles. The first report will be launched in October 2022.

This project will build a collaborative space for key stakeholders to advance the developments of IIPS together. The report will raise the profile of IIPS and promote understanding of the current landscape and trends in Africa. It will also provide through events, forums, and webinars, an opportunity for stakeholders to develop partnerships and leverage best practices for future development of IIPS.

We are excited to embark on this journey and invite you to contribute your thoughts, questions, and comments : info@africanenda