News

SIIPS 2024 - Three elements that differentiate inclusive instant payment systems

by Sabine Mensah, Deputy CEO - 16 August 2024

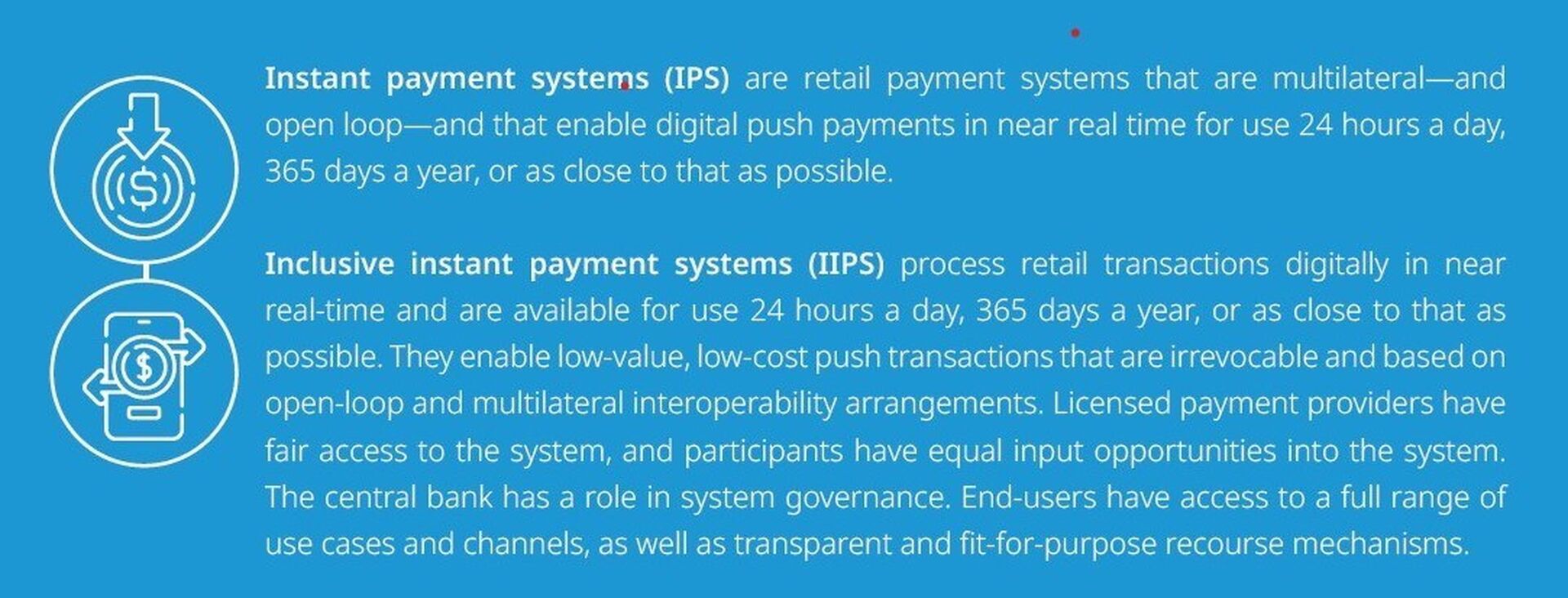

Instant payment systems (IPS) process payments digitally in near real-time and are available for use 24 hours a day, 365 days a year. Imagine an instant payment system that doesn't just move money but also prioritizes inclusivity, working towards a fairer equitable financial landscape for everyone. AfricaNenda is striving to make this vision of Inclusive Instant Payment System (IIPS) a reality across Africa.

What are IIPS?

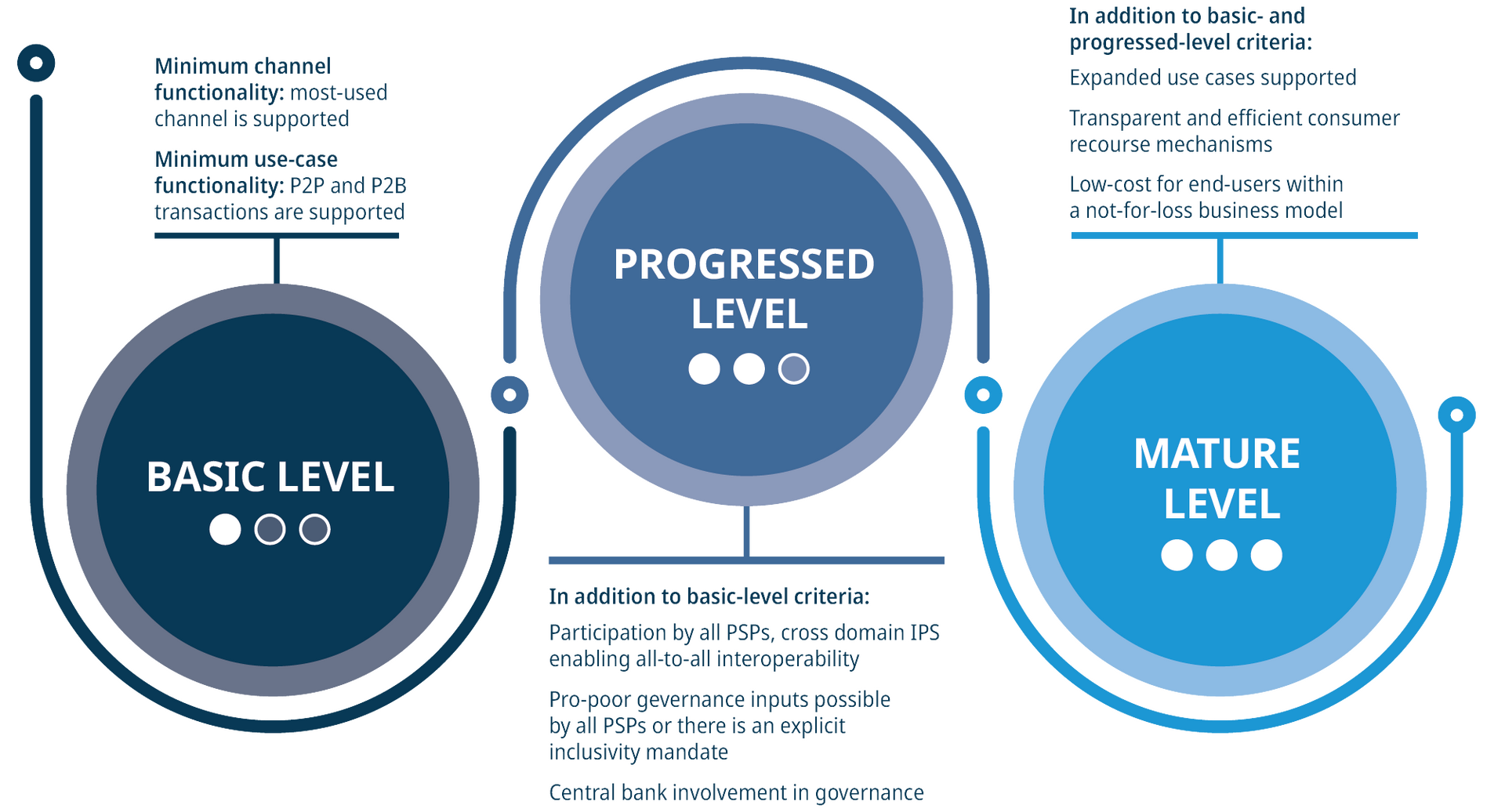

For the third year in a row, our annual State of Inclusive Instant Payment Systems (SIIPS) 2024 report, maps out the instant payment systems (IPS) in Africa on an “inclusivity spectrum.” The spectrum categorizes IPS based on where they are today and identifies high-potential improvements that could drive greater inclusivity. To evolve into truly inclusive IPS (IIPS), these systems must meet the aspirational benchmark described in the inclusivity spectrum bellow, based on features such as inclusive governance, structure, interoperability, and the depth and breadth of channels, functions, and use cases it operates.

The AfricaNenda IPS Inclusivity Spectrum

There are, however, three common elements more inclusive systems do differently compared to their less inclusive peers, as follows.

Element #1: Consumer-centricity

IIPS puts the consumer first by enabling functions that reflect the needs of the market. In markets where mobile money is the preferred channel, for example, the IPS at the very least supports mobile money transactions. These systems prioritize the largest share of end-users, not just the most profitable segment.

Enabling person-to-person (P2P) transfers is key for initial adoption and according to the 2024 IPS landscape, all systems in Africa support this. However, to keep money digital, other use cases like merchant and bill payments (P2B) are necessary. Progressed systems offer at least two or more use cases, allowing individuals and businesses to make all their transactions digitally, without recourse to cash. That ensures that digital payment becomes habitual and removes the risk of wallets and accounts simply functioning as mailboxes for cashing out.

Use cases are not the only element of customer centricity. Functions and channels also matter, as they can increase convenience and accessibility for customers. For example, proxy identifiers such as QR codes and mobile phone numbers make digital payments more accessible, while channels such as USSD to cater for individuals with basic or feature phones. According to GSMA (2023), half of cellular connections in Sub-Saharan Africa are basic or feature phones. Though it is ultimately up to the payment provider to decide which functions and channels they offer their end user, IPS can encourage more inclusive delivery by offering a full menu of customer centric options.

What’s next in customer centricity?

The widest array of use cases and functions mean very little if end-users cannot access them where they live or do not trust them. SIIPS 2024 consumer research conducted in five African countries found that a lack of reliable access, as well as fear of fraud and scams, are top of mind for end users and serve as barriers to digital payment usage. That finding is consistent with the end user research from SIIPS 2022 and 2023 conducted in different countries.

To reach the mature level on the AfricaNenda IPS Inclusivity Spectrum, a system must establish standards for consumer recourse and ideally provide a direct channel for customers to dispute a transaction if their PSP cannot resolve the issue. Beyond establishing standards, an IPS must ensure that consumers are aware of the recourse options available to them and that they are able to use them. The consumer recourse element is still at the nascent stages for most systems and represents the next challenge for most progressed systems.

Element #2: Inclusive governance

Another key element of IPS inclusivity involves having mechanisms in place to give all the stakeholders the opportunity to have a voice in decision-making. This includes the participants (i.e. the PSPs) and the regulator. Systems that allow both banks and non-bank PSPs to participate and have a say in system design and rules avoid having one or a few powerful incumbents dominate at the expense of smaller players or new entrants. Involving the central bank in governance ensures commercial interests do not override inclusivity goals and provides a direct channel for advocating policy and regulatory modernization.

Examples of inclusive governance:

- Build it directly into the shareholder structure. Natswitch in Malawi gives banks and MMOs equal shareholding, with each entity holding one vote. The Reserve Bank of Malawi (RBM) does not have direct input into decision-making but there is three-way consultation between Natswitch, RBM, and the participants.

- Build it indirectly through working groups or stakeholder forums. The two systems in Ghana—MMI and GIP—are both fully owned by the Bank of Ghana. To receive inputs from participants and other key stakeholders, they have a committee which is further organized into specific working groups. The committee includes public and private entities such as the Ministry of Finance, the Chamber of Telecommunications, and the Association of Bankers. The working groups, in turn, include members across mobile network operators, merchants, end users and PSPs (BFA Global, 2022).

What’s next for inclusive governance?

Most IPS have some central bank involvement in governance. IPS have also made headway in creating platforms for participant-input. Many of the systems still do not cater to the full range of bank and non-bank PSPs, however. Indeed, in 2023, only 14 of the 32 IPS included in the SIIPS report landscape were cross domain systems offering all-to-all interoperability—meaning, they allowed customers to transact with the entire financial ecosystem regardless of which provider holds the sending or the receiving account (bank or mobile money for instance). The first next step for non-cross-domain IPS would be to transition to cross-domain interoperability and with that transition extend input processes to include the new participants.

Element #3: Low costs for participants and end-users

Exorbitant transaction costs can be a barrier to usage for end-users. To establish the conditions for low-cost digital payments, IPS must consider two key elements: sufficient volumes and values processed through the system, and a not-for-loss business model.

- Achieving sufficient scale in volumes and values. Economies of scale help systems achieve lower per-transactions costs. One way to drive scale is by onboarding more participants, which ideally will expand reach to a broader pool of end users, thus enabling the IPS to spread the cost of setting up and maintaining the system. In theory, digital-first PSPs who leverage technology and innovative distribution models can more efficiently reach new, historically underserved end-users, compared with a brick-and-mortar bank. IPS can also drive scale by supporting a wider range of use cases, especially those that can provide a consistent source of volume, such as bulk government-to-person payments delivered directly into an account, including social assistance, public salaries, wages, or pensions.

- A not-for-loss business model: IPS can also help drive low costs by operating with a not-for-loss or cost-recovery business model, with oversight into participant pricing.

- NIP in Nigeria is the only system that has enabled all use cases, translating into a high volume of transactions running through the system—in 2023 it processed transactions equal to 98% of the country’s Gross National Income (GNI). The operator, NIBSS, adheres to a cost-recovery business model (AfricaNenda, 2022). To avoid having PSPs pass on high fees to end users, the Central Bank of Nigeria caps transaction prices. At this scale and with that business model, the system has the potential to sustain itself based on its high usage.

What’s next for lowering digital payment costs?

The majority of progressed systems already operate on a not-for-loss/cost recovery business model to ensure a low cost for participants. The question of participant cost and customer pricing dynamics within the IPS ecosystem remains complex and requires further research for data driven recommendations, however. Nevertheless, the example of NIP in Nigeria illustrates the value of offering expanded use-cases to drive transaction uptake, even directionally. IPS should thus strive towards enabling further use-cases to achieve scale and inclusivity.

The upcoming SIIPS 2024 report will include the full detail and methodology of the AfricaNenda IPS Inclusivity Spectrum and additional updates. It will show where the different systems fall within it and their evolution. Stay tuned for the launch event happening in Accra, Ghana very soon and check the SIIPS 2023 launch video.