News

Let’s change the game, hand in hand with the unbanked

by Sabine Mensah, Deputy CEO, AfricaNenda - 13 September 2021

Let’s listen to the unbanked

Across Africa, over 400-million financially excluded adults are missing out on opportunities to secure and grow their savings, to access loans to support their households and businesses, and to use insurance services to protect their households and livelihoods. At the same time, even among the Africans who have access to formal financial services, there is sometimes reluctance to use them.

It does not have to be this way. When the formally excluded Africans are asked why they don’t use formal financial services, they evoke multiple reasons, including their limited and irregular resources, the high cost of formal financial services, their limited access to banking infrastructure, and the fact that these solutions are not designed to address the needs of the poor.

There is a missed opportunity here. Indeed, being financially excluded does not mean that one is not financially savvy. Money hidden under the mattress, invested in livestock, or put through rotating savings and credit associations (ROSCA) or tontine/chama, are common money-grossing schemes across Africa.

Every day, millions of people exchange cash and goods, buy, pay, save and invest, all with incomes that are sometimes below US$2 a day.

Every day, millions of people exchange cash and goods, buy, pay, save and invest, all with incomes that are sometimes below US$2 a day. The poor engage in multiple and complex informal financial management mechanisms to create coping strategies in life, as highlighted by several research pieces, including insights from CGAP’s Money, Decisions and Control research. If that isn’t financial savvy, I don’t know what is!

For formal financial services to be attractive to such financially savvy women and men, they have to offer a compelling and competitive alternative to cash and the informal systems. Turning mattress savings into additional income with interest, opening the door to uncollateralised lending, micro-insurance and small-scale investment schemes accessible to the bottom of the pyramid are some examples of what could make digital financial services very appealing to the un- and underbanked.

It will indeed take such incentives and creative financial solutions, which are affordable and available anytime and anywhere, regardless of providers, technology and channels, to trigger the mass transition from the informal to the formal financial system.

No access, no usage

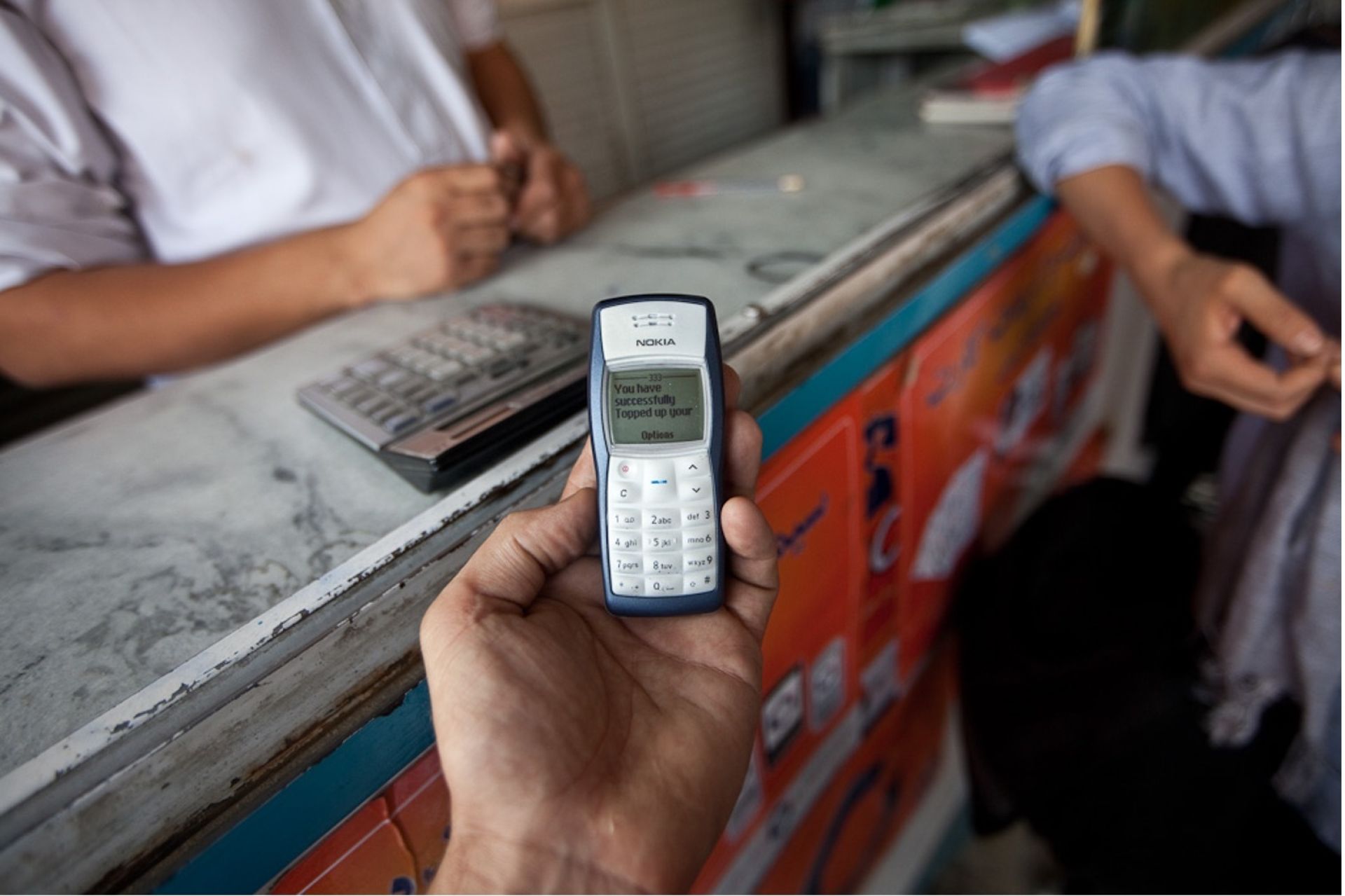

The 2021 GSMA State of the Industry report on mobile money highlighted that in 2020, spurred in part by the global pandemic, the number of registered mobile money accounts in Africa grew by 12% to 562-million accounts, with 161-million accounts active 90 days after registration.

More than 15 countries on the continent boast triple-digit mobile penetration rates, with users often holding multiple SIM cards.

More than 15 countries on the continent boast triple-digit mobile penetration rates, with users often holding multiple SIM cards. Mobile phones can make a unique contribution to the informal-to-formal transition by leapfrogging legacy payment systems and fast-tracking financial inclusion of the unbanked in Africa. Given the choice in a remote village or any rural area in Africa, why would anyone spend hours walking miles to the nearest brick-and-mortar financial institution, waiting in line, and then taking a long walk back home?

More flexible alternatives now exist through mobile money, including real-time payments, facilitated by a surge in cash-in and cash-out agent locations that have outpaced bank locations over the past decade. But while mobile technology has the potential to enable mass access, it will be transformational only if the ecosystem goes beyond cash-in and cash-out transactions, to offer game-changing services that address the needs of unbanked customers – such as interest-bearing micro-deposits, digital lending circles, small no-collateral loans and micro-insurance.

Access, the common denominator

Inclusive payment systems can be the connective tissue for financial inclusion, in turn promoting intra- and inter-regional trade in Africa.

Pushing the boundaries of the formal economy to enable an inclusive digital economy for all can only happen if it is based on, and fuelled by, instant and interoperable payment systems. The progress of digital financial services in Africa is undeniable; yet a customer still struggles to send money from Senegal to Kenya because the recipient has a wallet with a different provider and funds in a different currency. I have seen many women traders in marketplaces moving merchandise from North to West Africa and from Southern to Central Africa, and their major constraint is how to pay remotely and move money safely, reliably and affordably.

Furthermore, paying digitally can give users better access to credit and financial services further up the credit ladder, because an ecosystem of financial service providers can start building their credit profile and rating. Paying digitally also provides a means to hold users’ funds, enabling them to receive, send, transfer and invest down the line. Inclusive payment systems can be the connective tissue for financial inclusion, in turn promoting intra- and inter-regional trade in Africa.

AfricaNenda in the decade of action

At AfricaNenda, we believe that the growth of instant and inclusive payment systems (IIPS) is critical to achieving universal financial inclusion in Africa by 2030, improving the African economy and promoting the well-being of Africans of all walks of life. Our team brings together experts in digital payments and leaders with regional expertise to support African institutions, governments and the private sector.

We intend to build our contribution to the decade of action in reaching the Sustainable Development Goals by providing pre-project support, technical assistance and capacity building to African institutions, governments, regional economic communities and private sector actors across Africa. By accelerating the scale-up of inclusive instant payment systems, we can bypass access frontiers to opening gateways to financial inclusion for all. We look forward to engaging development actors, the United Nations, donors, academics and other stakeholders to prepare the ground for instant, inclusive and interoperable payment systems across Africa.

#IamAfricaNenda, and I am thrilled to be a part of this journey towards universal financial inclusion in Africa. To learn more about our work, don’t hesitate to reach out to me, our CEO, Robert Ochola, or my fellow Deputy CEO, Akinwale Goodluck.