Articles

Carnet de route — des dynamiques convergentes au service de l’inclusion : enseignements de Pix au Brésil

par Sabine F. Mensah, directrice générale adjointe à AfricaNenda Foundation - 20 août 2025

J’ai eu l’honneur en juillet dernier de participer à la Global Payments Week(« GPW ») 2025, organisée les 7 et 8 juillet à Brasilia (Brésil) par la Banco Central do Brasil (« BCB »), en collaboration avec la Banque mondiale et le Comité sur les paiements et les infrastructures de marché (« CPMI ») de la Banque des règlements internationaux (« BRI »). Cet événement de haut niveau a offert une plateforme privilégiée d’échanges sur des questions novatrices en matière financière — telles que la tokenisation, les actifs numériques, l’intelligence artificielle, l’informatique quantique et les technologies de conformité réglementaire (regtech). Il a également permis d’enrichir le dialogue avec les banques centrales et les autorités de régulation d’Afrique et d’ailleurs, ainsi qu’avec certains représentants du secteur privé.

L’un des temps forts de la GPW 2025 aura toutefois été l’occasion unique d’approfondir la connaissance de Pix, le système de paiement instantané (« SPI ») inclusif du Brésil, un système que l’on désigne également comme un système de paiement rapide (« FPS »). Lancé en 2020, en pleine pandémie de COVID-19, Pix a été conçu comme un système de paiement de détail ouvert à l’ensemble des fournisseurs de services financiers et de paiement immatriculés au Brésil. Il a ainsi permis une adoption quasi immédiate des paiements numériques. En présentant de manière approfondie son parcours aux participants de la GPW 2025, dont plusieurs pays africains, l’équipe de la BCB a transmis des enseignements de premier plan dont nous, Africains, pouvons tirer des enseignements pour développer des systèmes analogues. Comme l’a souligné Renato Gomes, gouverneur adjoint chargé des agréments et de la résolution bancaire dans son allocution d’ouverture : « Pix a transformé la vie quotidienne au Brésil… et ce succès est le fruit d’une étroite collaboration entre l’équipe de la BCB et l’ensemble des banques et fintechs participantes. »

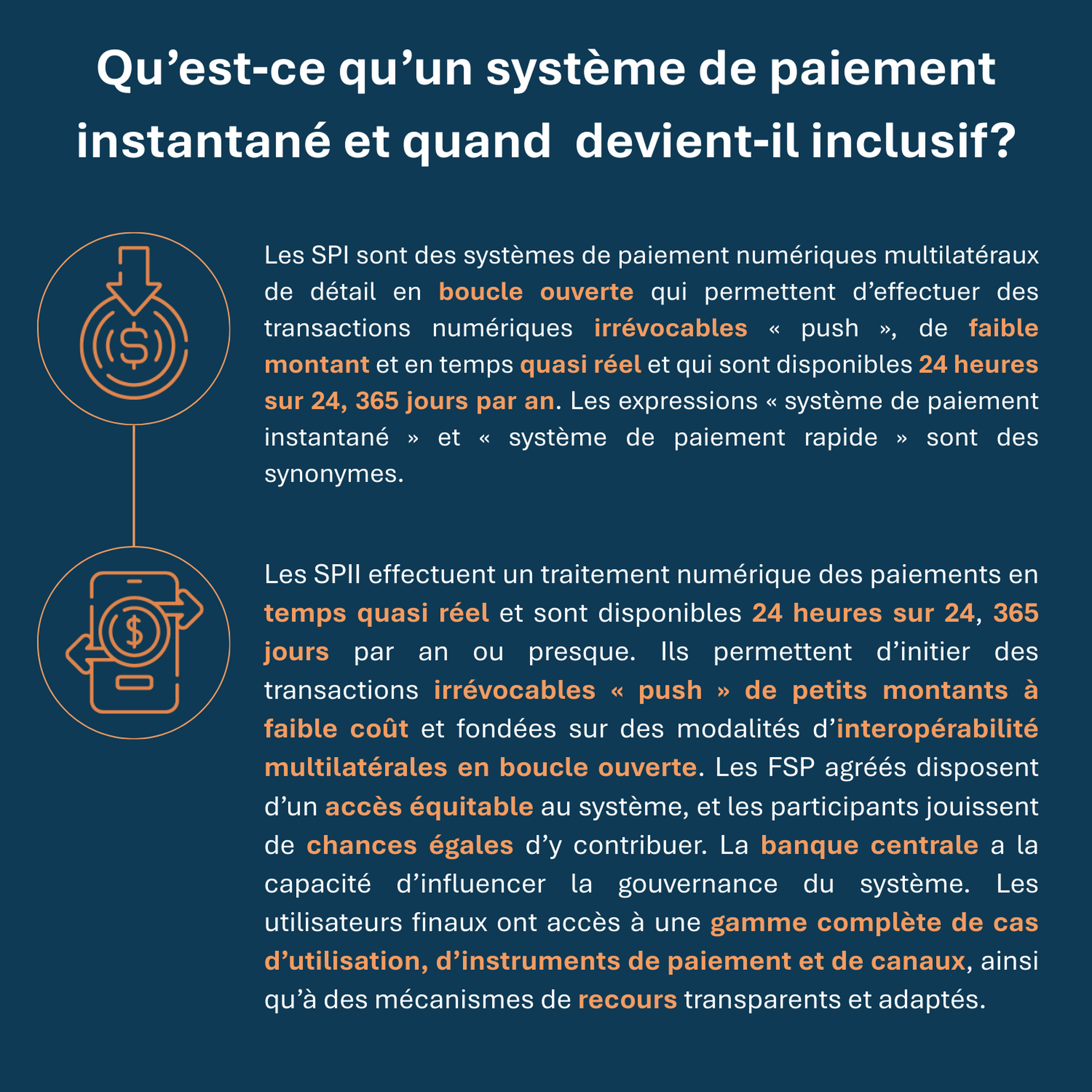

Partir d’une compréhension commune

Selon les estimations de la BRI, plus d’une centaine de pays disposent d’un FPS[1]. En Afrique, notamment, la croissance des SPI s’est révélée particulièrement dynamique. Le rapport État des lieux des systèmes de paiement instantané inclusifs en Afrique (« SIIPS »), publié par AfricaNenda Foundation, recensait 31 SPI opérationnels sur le continent en 2024[2]. Les paiements instantanés permettent aux particuliers comme aux entreprises d’initier des transactions par voie numérique et de garantir que les fonds parviennent au bénéficiaire en quelques secondes, 24 heures sur 24, 7 jours sur 7 et 365 jours par an. L’expérience acquise avec Pix au Brésil permet de dégager trois enseignements essentiels pour orienter la conception et l’expansion des SPI inclusifs sur le continent africain[3].

Enseignement no 1 : le rôle moteur de la banque centrale est déterminant.

L’histoire de Pix, conçu et exploité par la BCB, a débuté par des réformes réglementaires, près d’une décennie avant son lancement en novembre 2020. Dès 2013, le Congrès national du Brésil a adopté la loi no 12 865/2013 relative aux agréments, à la réglementation et à la supervision des institutions et dispositifs de paiement. Cette loi, complétée par d’autres évolutions réglementaires, a posé les jalons essentiels à la mise en place d’un système de paiement instantané inclusif performant.

La définition de priorités claires dès l’origine, et leur réajustement au fil du temps, s’est également révélée essentielle. Ainsi, tous les quatre ans, la BCB réalise une enquête sur l’usage des instruments de paiement et les contraintes du marché, afin de s’assurer qu’elle répond bien aux problèmes rencontrés. Une compréhension fine de l’écosystème de paiement permet en effet d’élaborer une proposition de valeur convaincante pour favoriser l’adoption future d’un SPI. En 2018, la BCB a procédé à une analyse globale du paysage des paiements dans le but d’identifier les lacunes de l’écosystème et de mieux cerner les points de friction rencontrés par les consommateurs, les commerçants et les fournisseurs de services de paiement (« FSP »).

Le succès du système repose également sur l’inclusion effective des principales parties prenantes appelées à bénéficier du système. Dans cette perspective, la BCB a associé de manière proactive un ensemble diversifié d’acteurs clés dès la phase de conception, en créant en 2018 un groupe de travail, institutionnalisé par la suite sous l’appellation Forum Pix[4]. L’ambition fixée pour Pix au Brésil était claire : « … permettre des paiements partout, pour tous, pour tout type de transaction, à tout moment et de manière instantanée[5]. »

Enseignement no 2 : l’inclusivité doit s’étendre à la gouvernance, à la technologie, aux politiques publiques et à l’orientation utilisateur.

Au Brésil, la BCB a investi 2 millions de dollars de fonds publics pour faire de Pix le pilier des paiements de l’infrastructure publique numérique (« IPN ») du pays, avec l’ambition de le mettre au service de toutes les Brésiliennes et de tous les Brésiliens. La banque centrale disposait déjà d’une solide expertise technique interne, acquise à l’occasion de la mise en place en 2002 du système de règlement brut en temps réel du pays (Reserve Transfer System, « STR »).

La BCB a élaboré le cadre réglementaire et opérationnel de Pix conjointement avec l’industrie des paiements et la société civile. L’instauration d’une gouvernance et de principes de conception inclusifs a été rendue possible grâce à une stratégie cohérente et transparente d’implication des parties prenantes, incluant des consultations régulières. Le Forum Pix, fruit des premières actions de concertation avec les parties prenantes menées par la BCB, comprend quatre groupes de travail consacrés respectivement aux aspects commerciaux, aux exigences techniques, à la messagerie et à la sécurité. Ses participants regroupent des représentants de plusieurs associations sectorielles, telles que les banques, les établissements non bancaires, les FSP, les consommateurs, les entreprises et les agences gouvernementales.

Les choix technologiques peuvent conditionner la volonté des participants de prendre part à un SPI. La connexion, l’intégration ou la migration vers une nouvelle technologie peuvent entraîner des coûts importants pour les participants bancaires et non bancaires à un SPI. Les dispositifs peuvent contribuer à faire pencher la balance en proposant des choix technologiques qui facilitent l’intégration des participants, et les banques centrales peuvent, en stimulant davantage la participation, accroître l’ampleur du système, ce qui permet de réduire les coûts. Sur le plan technologique, la BCB a développé Pix sur la base de normes ouvertes assorties de protocoles de sécurité renforcés, et a mis à disposition des API normalisées pour les initiateurs de paiement tiers. La plateforme a été conçue pour permettre des évolutions progressives, propices à des innovations abordables à long terme et à un passage à grande échelle.

La BCB a également pris très tôt la décision d’imposer la participation obligatoire de toutes les banques et de tous les FSP gérant plus de 500 000 comptes courants ou comptes prépayés[6]. Grâce à cette mesure, Pix a pu être accessible à plus de 90 % des titulaires de compte au Brésil dès le premier jour. En décembre 2024, Pix comptait 35 participants obligatoires et 843 participants volontaires. Chaque participant est relié au système de règlement, soit directement, soit indirectement par l’intermédiaire d’un sponsor chargé de la gestion de liquidité.

Enfin, Pix repose sur des principes centrés sur l’utilisateur.

Tous les participants doivent se conformer à des exigences minimales en matière d’expérience utilisateur, et aucune commission n’est appliquée aux transactions Pix initiées par des particuliers. Cette approche permet de démarquer les paiements numériques par rapport aux opérations en agence, en termes de gains de temps et de coûts notamment. D’importants investissements ont été réalisés pour développer la marque Pix et pour mener des actions de communication et de sensibilisation visant à faire connaître sa proposition de valeur aux consommateurs. Ces efforts ont permis de renforcer la confiance des consommateurs brésiliens à l’égard des paiements numériques. En outre, des mécanismes antifraude ont été instaurés pour protéger les consommateurs, notamment un dispositif spécifique de remboursement permettant de bloquer les fonds en cas de réclamations pour fraude.

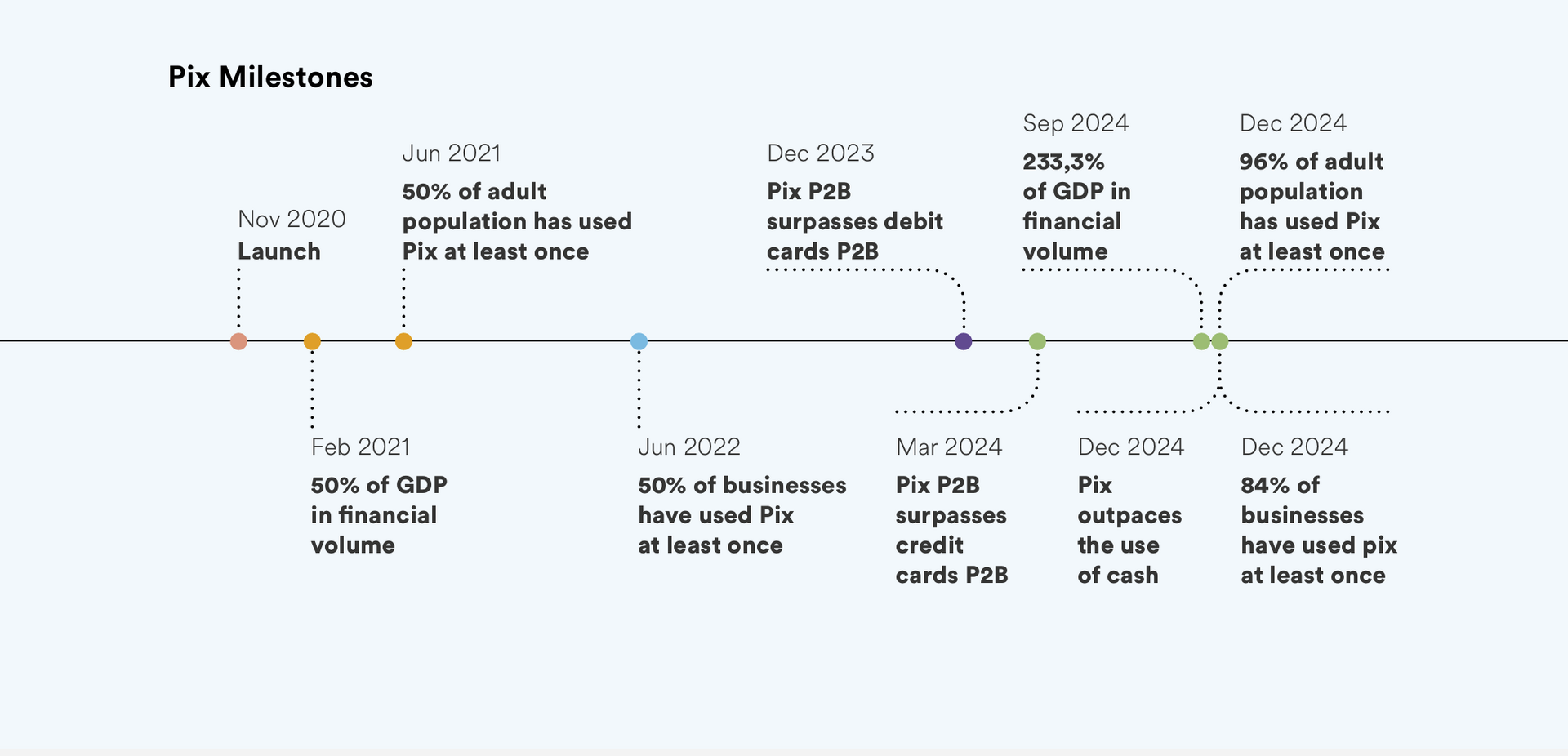

Enseignement no 3 : tout repose sur la valeur — les résultats parlent d’eux-mêmes.

En 2024, 22 % de l’ensemble des paiements au Brésil étaient effectués en espèces, contre 77 % en 2019[7]. Pix a traité 63,44 milliards de transactions pour une valeur totale de 4 490 milliards de dollars en 2024, soit l’équivalent de 226 % du PIB du pays ; 96 % de toute la population adulte et 84 % des entreprises ont recouru à ce système en 2024. Pix illustre de manière exemplaire la capacité d’un pays à croire au potentiel de l’IPN pour transformer sa trajectoire de développement et générer des bénéfices accessibles aux consommateurs, aux entreprises et aux pouvoirs publics, et à se donner les moyens de concrétiser cette vision. La recette du succès réside dans l’association d’obligations et d’incitations intelligentes visant à amener les banques et les FSP à rejoindre et promouvoir Pix, ainsi que d’incitations destinées aux utilisateurs finaux, notamment la gratuité des transactions pour les particuliers et des frais d’acceptation abordables pour les commerçants. Les unes et les autres reposent sur une plateforme agile et fiable, capable d’évoluer aisément dans un environnement réglementaire favorable à l’innovation et proportionné aux risques. L’Afrique peut tirer parti de ces enseignements dans l’évolution de son écosystème de SPI. Comme l’a déclaré Breno Lobo, responsable de l’équipe de la BCB dédiée à Pix : « Pix a atteint ses objectifs de politique publique — tels que l’accroissement de la concurrence et de l’efficacité sur le marché des paiements de détail, la réduction du recours aux espèces et la promotion de l’inclusion financière et numérique — bien plus rapidement qu’attendu. Le rôle moteur de la BCB et l’implication directe du secteur privé et de la société civile ont été déterminants. »

J’ai hâte de revenir sur ces enseignements en novembre, à l’occasion du lancement en Eswatini de l’édition 2025 du Rapport SIIPS en Afrique d’AfricaNenda Foundation, et d’y partager nos analyses sur les remarquables avancées du continent en matière de systèmes de paiements instantanés inclusifs, moteurs de la transformation grâce aux infrastructures publiques numériques.

Références:

[1]https://www.bis.org/publ/qtrpdf/r_qt2403c.pdf

[2]https://www.africanenda.org/en/siips2024

[4]https://www.labrys.one/public/research-publication/pix-gold-standard

[6]https://www.labrys.one/public/research-publication/pix-gold-standard

[7]https://www.labrys.one/public/research-publication/pix-gold-standard