الأخبار

Daily Life of a Market Merchant

بواسطة Sabine Mensah, Deputy CEO at AfricaNenda - 17 فبراير 2026

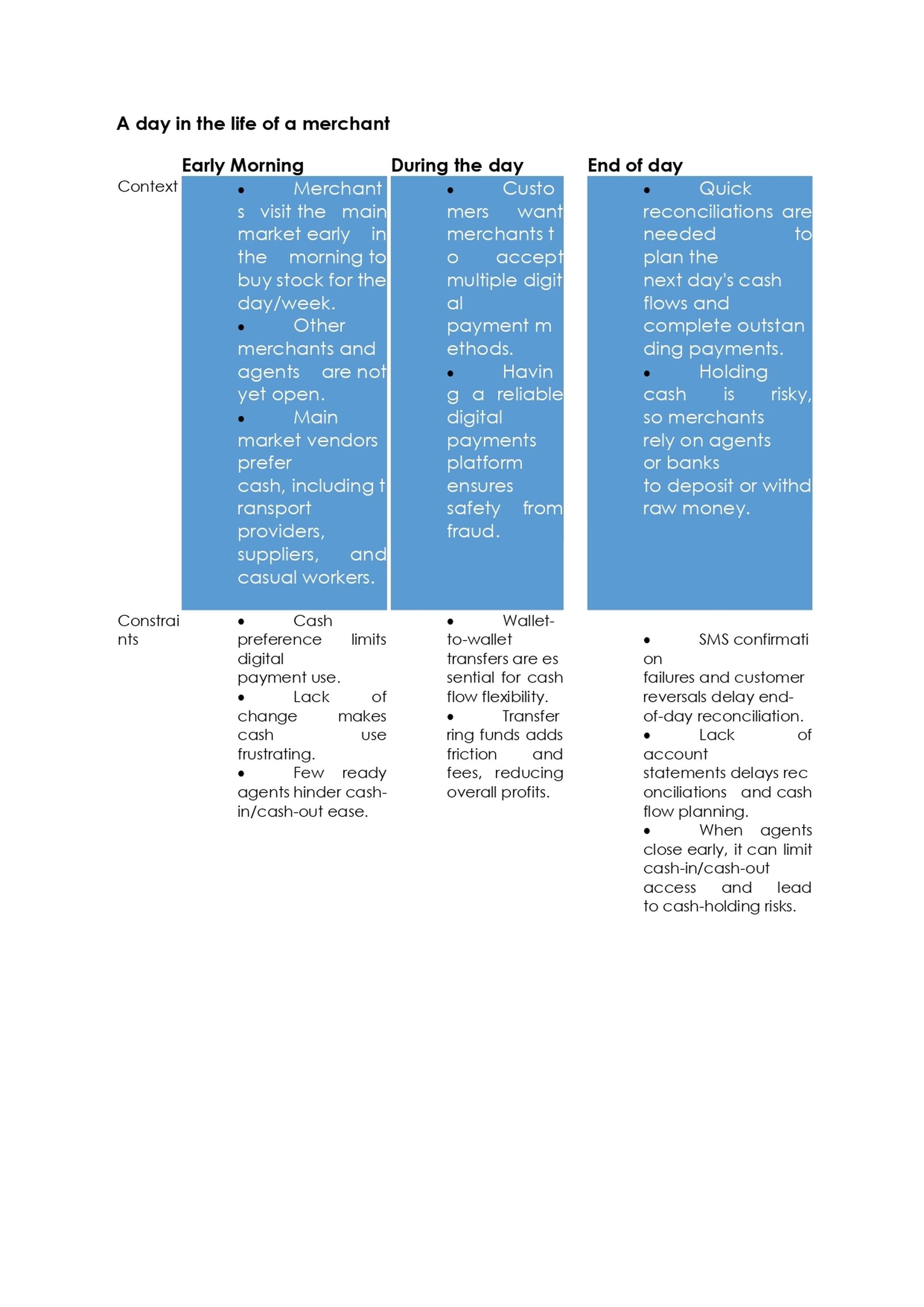

Understanding the day-to-day routines of a micro business operator navigating the hybrid world of cash and digital payments

For merchants, the promise of digital payments is that they make life easier, faster, safer, and more efficient. However, merchants experience significant variability in cash flow throughout the day, which influences not only how they operate but also when and how they use digital payments. This finding, drawn from consumer research conducted in Angola, Côte d’Ivoire, Madagascar, and Tunisia, for the State of Inclusive Instant Payment Systems in Africa 2025 report—highlights the dynamic and time-sensitive nature of merchant payment behaviors.

Many merchants navigate a hybrid payments world that includes cash and digital, switching between them based on liquidity, certainty of transaction success, speed, and overall convenience. Their mantra is that money must always be working—moving, clearly visible, and accessible whenever it is needed. As a woman merchant in Côte d’Ivoire put it, “Digital payments are good—they make my work easier, and I can see my money.”

For the average merchant in the study sample, the day starts before sunrise

Early Morning

By 5:00 a.m., the main market is already in motion. Merchants arrive early to buy stock before daylight—when selection and prices are best. Cash dominates. Buying decisions happen quickly and involve multiple suppliers, including how much to buy, from whom, and at what price. Most suppliers and workers won’t accept digital payments. They favor cash because the micro nature of transactions in the market is ill-suited to the value proposition, cost, and user experience of paying digitally. Digital channels also feel unreliable and not fast enough, particularly due to frequent network issues and transaction delays. As one merchant put it, “If you make a mistake on the app or delay, someone else takes the items.”

Mobile money agents aren’t open yet in these early hours, and merchants use leftover cash from the previous day. Cash brings risks, however, including robbery, fake notes, and problems with finding change. Another woman merchant said she asks her husband or a friend to escort her to the market for extra cash safety.

Back in the shop, early morning sales are also predominantly in cash. It’s what is available, expected, and efficient at the moment.

During the day

During the peak hours of the workday, digital channels become essential—both for safety and customer convenience. Accepting multiple digital payment options signals to customers that the merchant is professional and ready for business. Merchants rotate between apps based on which ones are working that day; they do not have payment brand loyalty. Mobile money agents are open now, allowing merchants to top up wallets, pay remote suppliers, or assist customers who prefer to withdraw and pay in cash. Moving funds between wallets becomes crucial for cash flow flexibility, though it adds steps and incurs transaction fees, which reduces profit margins.

In high-pressure moments, uneven system functionality erodes trust. When transactions take a long time to go through or SMS confirmations fail, tensions rise, and sales are lost. “If the app freezes, the customer walks,” noted a merchant in Angola. SMS confirmations often serve as digital receipts, but some merchants struggle to verify the genuine ones—especially when a customer reverses a payment after a sale. “The money may be gone—or it may never have arrived,” one merchant explained, highlighting the uncertainty in receiving transaction confirmations.

As the day progresses, merchants become more aware of the risks of holding cash and begin preparing for the uncertainties of the day’s end. Some merchants ask customers to pay digitally, to lighten the load of cash held in the business.

End of day/evening

From 6:00 p.m., the day starts winding down—but pressure doesn’t. As evening approaches, merchants begin reconciling the day’s sales, closing their books, and preparing for the following day. Evening is also when digital payments as a business tool are most critically tested. Without robust reconciliation features, such as access to transaction summaries or statements, merchants must rely solely on SMS confirmations. When those messages fail to arrive—or when transactions are reversed without notice—closing the books becomes uncertain and prone to error. Attempts to resolve issues are often disappointing, because the customer care lines tend to be busy, delaying responses and undermining confidence in digital systems.

Holding cash overnight feels risky for some, essential for others. Those who rely on cash in the supplier markets may need to cash out the night before or pay suppliers before sundown. Agents may already be closed, however, and the open ones may lack sufficient float, leaving merchants with limited options. These constraints may push merchants who want to pay digitally to revert to cash, and those who need cash to delay the next day’s activities, simply because the system does not support their end-of-day needs. “If I don’t cash out today, I go home with no cash in hand, and I can’t use mobile money to buy tomorrow’s stock,” said one woman in Côte d’Ivoire. A merchant in Tunisia added, “I prefer digital, but I still carry cash. I must be ready for anything.” Another merchant in Madagascar shared, “We store the daily revenue in a lock safe, and later we make a bank deposit for security reasons.”

These narratives capture the real-life rhythm of Africa’s informal economy, where digital and cash payments coexist out of necessity. These merchant experiences reveal opportunities to reach underserved segments and drive last-mile inclusion—shaping the future of Inclusive instant payment systems that work reliably, every time.

Key takeaways

1.Digital payment solutions must consistently enable small-value, high-frequency payments beyond banking hours if they are to compete with cash.

To better serve informal merchants, the IIPS ecosystem needs to adapt to micro-merchants’ trading patterns, ensuring longer agent opening hours, and enabling intuitive user interface and affordable (low or zero) fees for small-value payments.

2. During peak hours, merchants using multiple platforms face a higher chance of errors and unreliable service—highlighting the need for interoperability.

Merchants in fragmented ecosystems face inconsistent experiences across platforms. This may take the form of unexpected fees, unreliable transaction confirmation of flows, or recourse, especially during peak hours. Interoperability of payment services will bring more convenience to merchants, strengthening the overall value proposition of digital payments. When agents are not nearby or lack float, merchants are unable to convert cash to digital value or vice versa. Therefore, having well-resourced agents within reach is also critical.

3. Instant confirmations build trust, especially for micro businesses without formal business tools. Make them universal.

Late in the day, merchants must reconcile sales, settle accounts, and prepare for the next business cycle. Instant, reliable transaction confirmation is essential for micro businesses that lack formal accounting tools. In contrast, delays or missing messages disrupt reconciliation and erode confidence. These quiet signals help users track payments, resolve disputes, and build trust in digital systems. For IIPS to serve all users effectively, transaction confirmation flows must be timely, universal, and integrated across platforms.